How to Write a Term Sheet?

A term sheet is a document where you can easily find the terms and conditions as well as other important details that an entrepreneur and an investor have agreed upon. This document must include the most important elements of a deal without providing too much detail on every minor contingency and must ensure that the parties involved in an investment or business transaction agree on the major aspects of the agreement, reducing the probability of misunderstandings as much as possible.

Step 1: Determine the Purpose of your Term Sheet

When you are drafting your term sheet, make sure that you are clearly and properly addressing the interest of the parties involved. Your term sheet must also include the reason for its writing, your target company at the center of your term sheet, and the date when you completed the document.

Step 2: Summarize the Terms and Conditions

In the first part of your term sheet, include a brief summary and explanation of the document’s terms and conditions, including the target company to which you are addressing the summarized terms and conditions, whether the document is legally binding or not, and the name of the buyer.

Step 3: Provide the Dividends, Liquidation Preference, and Provisions

Dividends refer to the profits distributed among the shareholders within a company, liquidation preference refers to the protection when an issue occurs, and provisions refer to the rights when operations did not go according to the plan, the company, as well as the funds of the investors that are at risk.

Step 4: Determine the Participation Rights

Participation rights are the rights that protect an investor if they chose to require a return on their investment in a company or business. With this protection, investors can confidently participate in an investment plan without risking the money they are investing.

Общий обзор

1. ПОЗВОЛЬТЕ опыту информировать и вызывать ваш обзор

Поиск правильного венчурного инвестора начинается с создания фундамента на основе видения, ценностей и доверия. Венчурный капитал на ранней стадии – это коллективное усилие, требующее выравнивания видений и установления доверительных отношений. Венчурные инвесторы, приносящие дополнительную ценность, обладают стратегическими преимуществами, опираясь на предыдущие исследования успешных и неуспешных кейсов в конкретных областях, и создают связи компаний с ценными партнерствами в области продаж и распространения. Установление прочных отношений с опытными инвесторами может помочь основателям добиться успеха, различая сигналы от шума и использовая знания отрасли.

2. НЕ СДАВАЙТЕСЬ

Успех в мире стартапов требует решимости, смелости, настойчивости, устойчивости и адаптируемости. Презентация перед венчурными инвесторами не исключение. Весь процесс может занять сотни встреч, прежде чем вы получите первый положительный ответ

Важно поддерживать оптимизм, при этом реалистически оценивая обратную связь и определяя необходимость привлечения венчурного капитала. Помните, что не каждой компании нужен венчурный капитал для успеха

Прибыльный рост и другие источники капитала могут быть жизнеспособными альтернативами.

Вопрос: Существуют ли какие-то особые качества или опыт, на которые инвесторы обращают внимание при выборе основателей?

Ответ: Венчурные инвесторы часто ищут основателей, проявляющих сильные лидерские качества, обладающих экспертизой в своей сфере и ясным пониманием своего рынка. Им также интересны основатели, способные ясно сформулировать привлекательное видение и обладающие способностью реализовать свои планы. Демонстрация тяги и прогресса на ранних стадиях значительно повышает шансы на получение инвестиций.

Avoid Mistakes

Here are some points for you to consider that may save you from fundraising errors thus failing to secure the term sheets you need to grow:

- Find an alternative to tracking your financials in Excel. Consider syncing your business accounts with accounting software such as Freshbooks, Quickbooks, KashFlow or Xero – most of which offer freemium accounts.

- Fully understand your numbers. Presenting financials that don’t match up will lead Investors to question your business acumen.

- If you have an investment roadmap, make sure the financials match up.

- Consider allowing a financial professional to look at your documents. You may be capable of crossing the Ts and dotting the Is but following this advice allows for a fresh pair of financial savvy eyes to look over your work and perhaps catch an error before it’s presented to Investors.

- Ensure that any customer contracts you share are signed by both parties – don’t present any pending contracts.

- Use testimonials or quotes from customers who have continuously renewed their contract or subscription. Not only does this show their loyalty to your product or service – their endorsement is delivered with more clout.

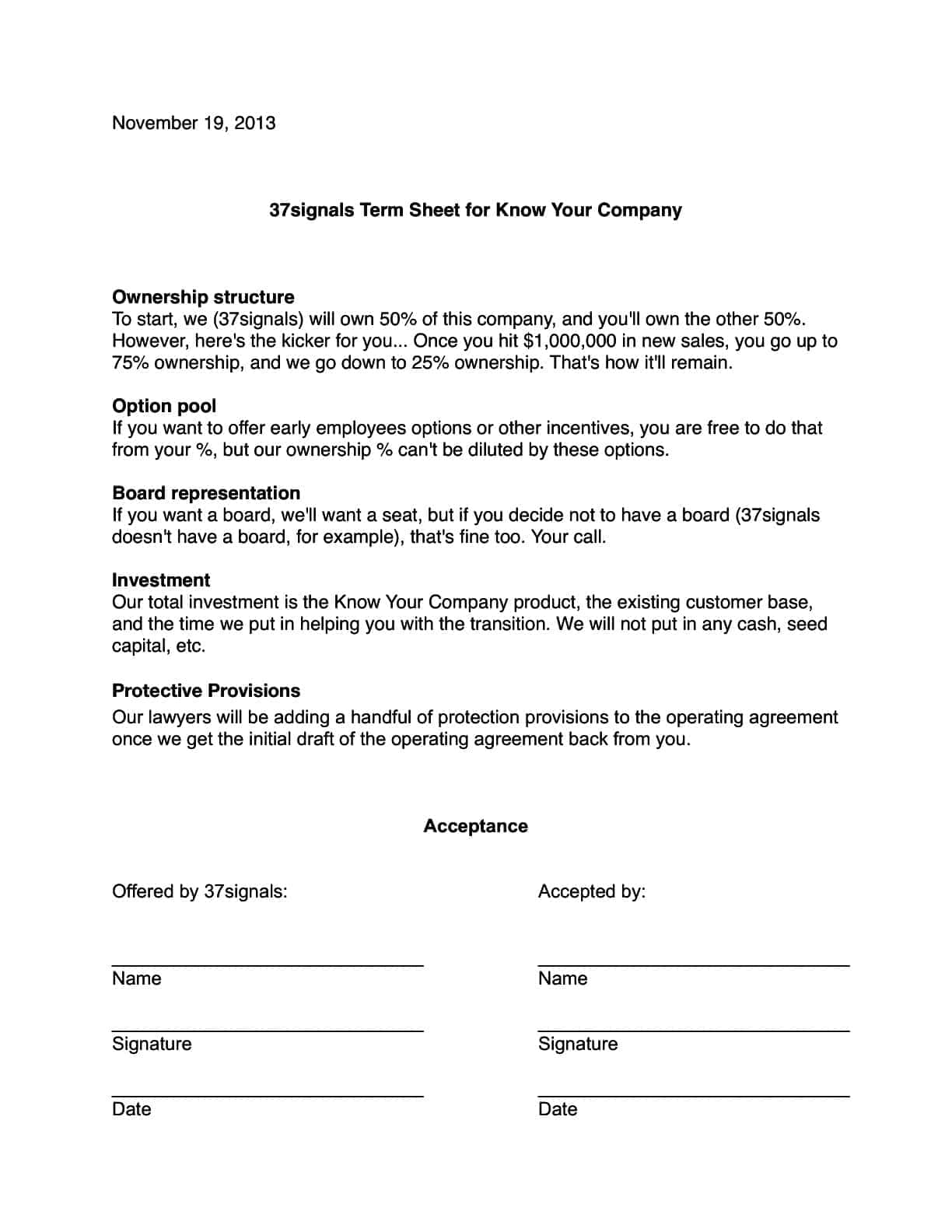

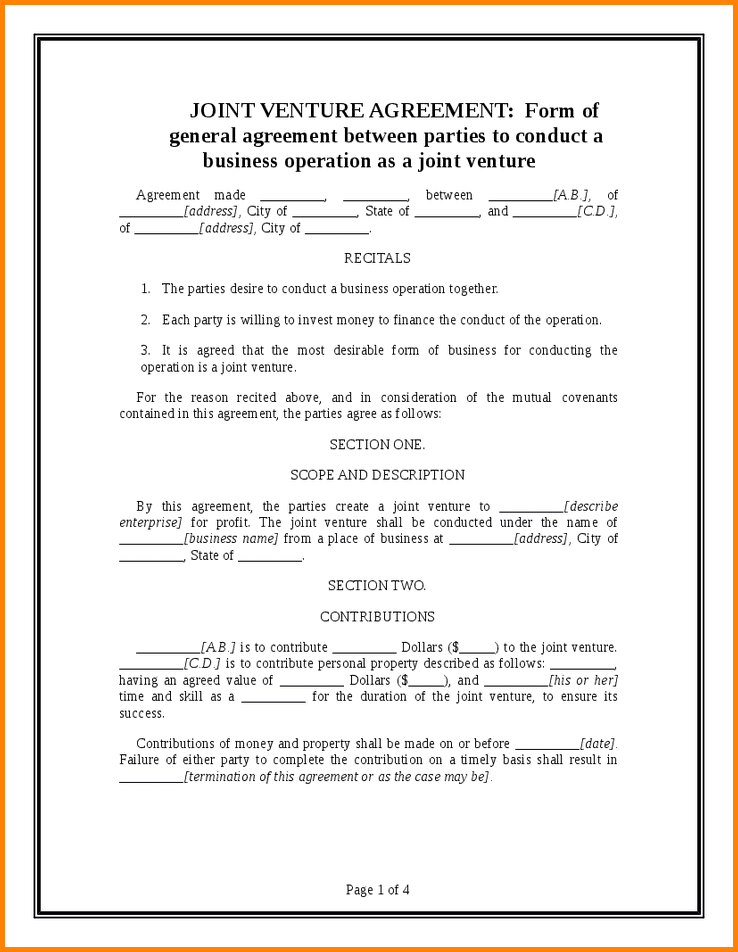

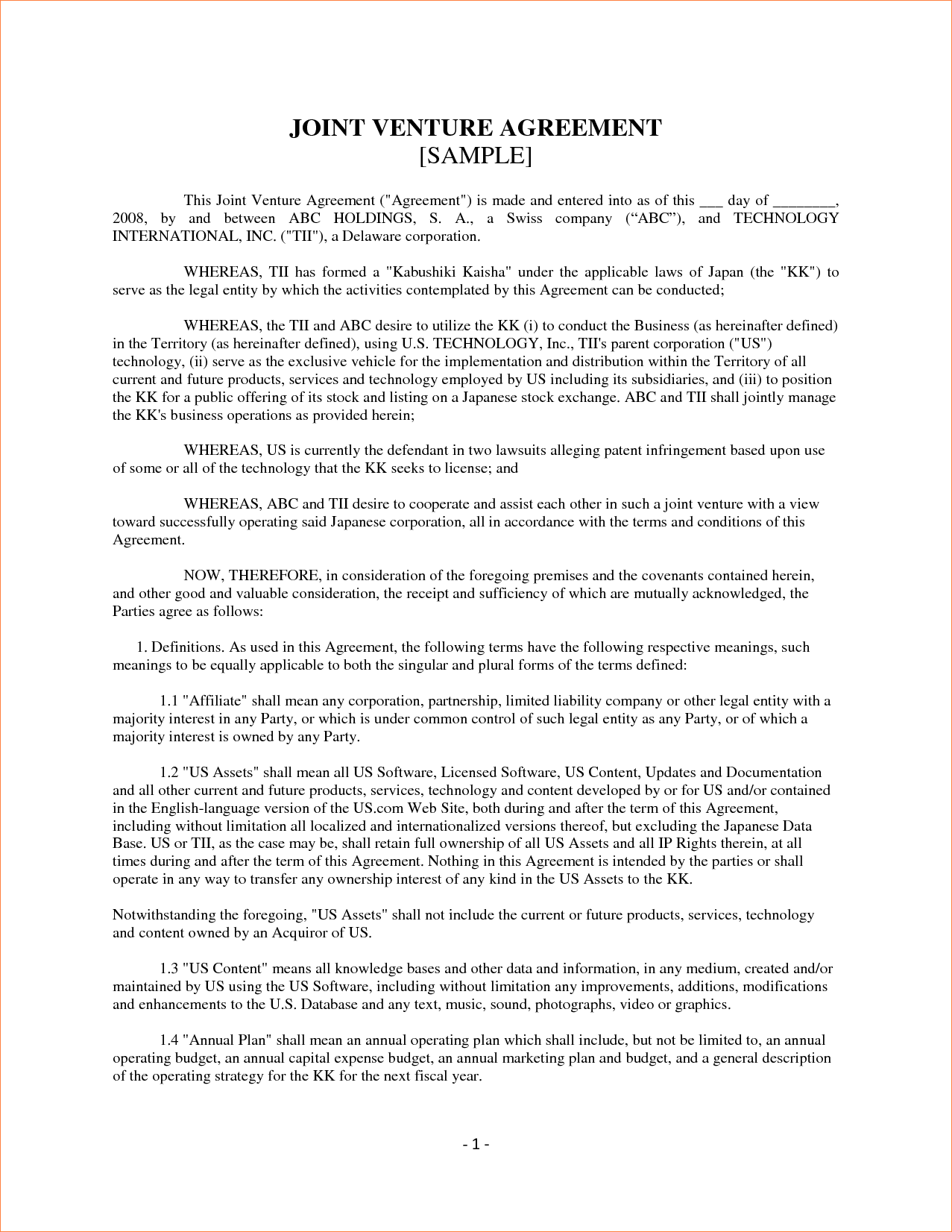

Joint Venture Term Sheet Sample: Understanding the Basics

Are you looking to enter into a joint venture agreement? A term sheet is a crucial component of the process. In this article, we’ll explore the basics of joint venture term sheet samples and how they can help you create a successful partnership.

Table of Contents

Joint venture agreements can be a fantastic way to grow your business and expand into new markets. However, before entering into a joint venture agreement, it’s important to create a term sheet that outlines the basic terms and conditions of the partnership.

A joint venture term sheet sample is a document that sets out the fundamental elements of the joint venture agreement. It outlines the key terms and conditions of the partnership, including the scope of the venture, the ownership structure, the distribution of profits and losses, and the responsibilities of each party.

Joint Venture Letter Of Intent And Joint Venture Terms

Joint Venture Letter Of Intent And Joint Venture Terms

One of the most critical aspects of the joint venture term sheet is the ownership structure. This section of the document outlines how the ownership of the joint venture will be divided between the parties. It’s important to ensure that the ownership structure is fair and equitable, and that it aligns with the goals of the partnership.

Another important aspect of the joint venture term sheet sample is the distribution of profits and losses. This section of the document outlines how profits and losses will be shared between the parties. It’s essential to ensure that the distribution of profits and losses is fair and that it incentivizes both parties to work together to achieve the goals of the partnership.

The responsibilities of each party are also a crucial component of the joint venture term sheet sample. This section of the document outlines the specific roles and responsibilities of each party, as well as the time frames for each task. It’s important to ensure that each party is clear on their responsibilities and that there is a clear understanding of the expectations for the partnership.

Joint Venture Term Sheet Agreement And Joint Venture Agreement Checklist

Joint Venture Term Sheet Agreement And Joint Venture Agreement Checklist

When drafting a joint venture term sheet sample, it’s important to ensure that it’s clear, concise, and comprehensive. The document should be written in plain language that’s easy to understand by both parties involved.

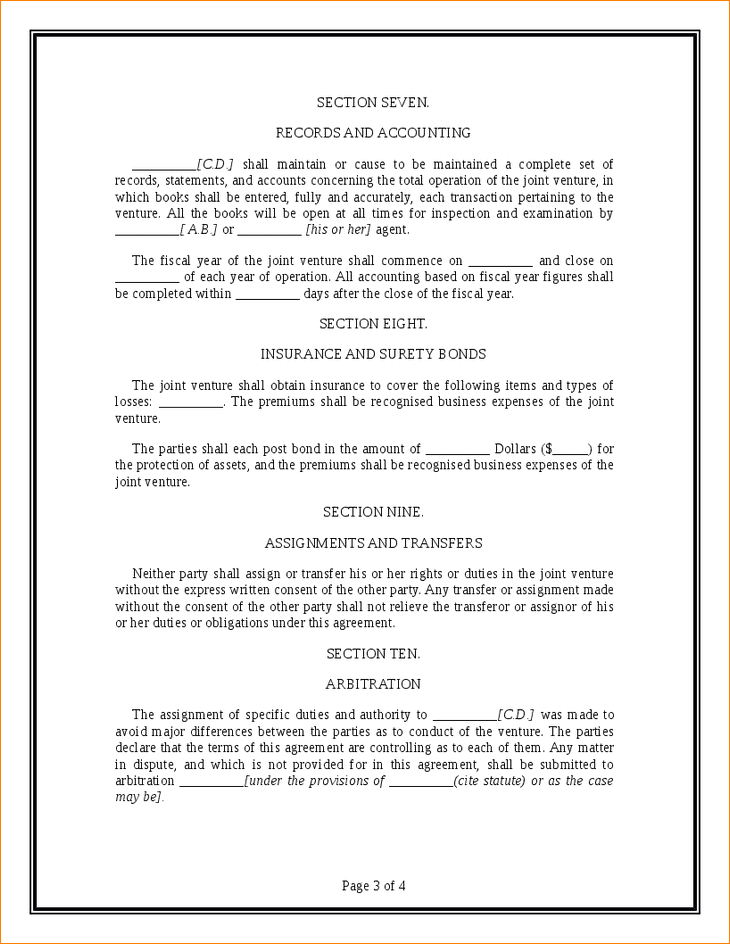

The joint venture term sheet should also include provisions for dispute resolution, termination, and the transfer of ownership. These provisions will help ensure that the partnership runs smoothly and that any issues are dealt with quickly and efficiently.

It’s also important to note that a joint venture term sheet sample is not a legally binding agreement. Instead, it serves as a roadmap for the joint venture agreement, outlining the key terms and conditions of the partnership. Once both parties have agreed to the term sheet, they can move forward with creating a legally binding joint venture agreement.

Joint Venture Term Sheet India And Joint Development Agreement Term Sheet

Joint Venture Term Sheet India And Joint Development Agreement Term Sheet

When creating a joint venture term sheet sample, it’s important to involve legal counsel. An experienced lawyer can review the document and ensure that it’s legally sound and that all relevant legal issues are addressed.

In conclusion, a joint venture term sheet sample is a crucial component of the joint venture agreement process. It sets out the fundamental elements of the partnership and helps ensure that both parties are on the same page. By taking the time to create a comprehensive and fair joint venture term sheet, you can set your partnership up for success and minimize the risk of misunderstandings or disputes down the line.

Joint Venture Term Sheet Pdf And Joint Venture Agreement Pdf

Joint Venture Term Sheet Pdf And Joint Venture Agreement Pdf

Joint Venture Term Sheet Sample And Joint Venture Agreement Doc

Joint Venture Term Sheet Sample And Joint Venture Agreement Doc

Как получить инвестиции через долевое финансирование

Как заключается договор

Существуют несколько вариантов того, как получить деньги в обмен на долю в бизнесе.

➤ Инвестор приобретает долю у владельца компании, а деньги получает не организация, а её участник. Такой тип сделок ещё называют cash out, поскольку собственник бизнеса может потратить деньги за долю по собственному усмотрению, например, на себя.

Когда продаётся доля в ООО, такой договор нужно удостоверить нотариально.

Если продавец владел долей менее 5 лет, у него возникнет налог при получении денег.

➤ Инвестор вносит денежные средства в компанию. В этом случае увеличивается уставный капитал юрлица, создаётся новая доля для инвестора, а финансирование поступает на счёт ООО.

В этом случае порядок действий такой:

инвестор и владелец бизнеса подписывают меморандум о намерениях↓инвестор и владелец бизнеса заключают договор о внесении вклада в уставный капитал↓компания, доля в которой приобретается, увеличивает уставный капитал за счёт взноса инвестора, а тот получает часть бизнеса.

В договоре о внесении вклада в уставный капитал стороны устанавливают свои обязательства:

- размер доли, которую приобретает инвестор;

- срок и форма оплаты доли;

- ответственность за нарушение договора и другие условия.

Для этого соглашения не обязательна нотариальная форма, но её может потребовать одна из сторон.

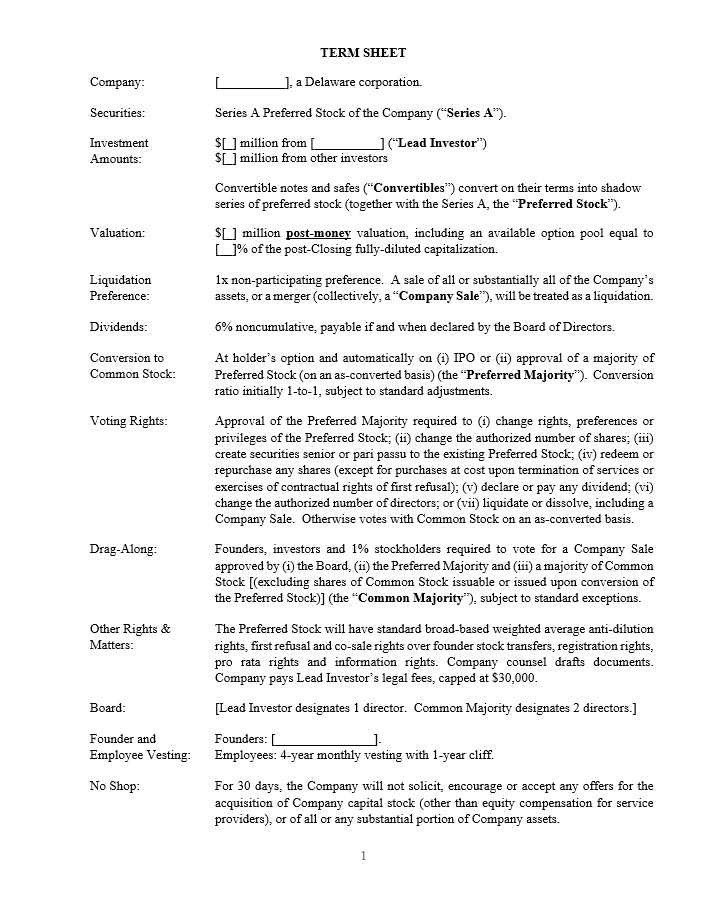

VC Term Sheet Example

So what does a VC Term Sheet actually look like?

In this section, we are going to break down the 7 common sections of a VC Term Sheet. Before we do though, it’s helpful to actually see what a few actually look like:

Sample Term Sheet Template

While a term sheet should always be created and negotiated by legal counsel, a free representative term sheet is available through the National Venture Capital Association (NVCA) and can be found here: https://nvca.org/model-legal-documents/

To see another example of a standard term sheet, Y Combinator (YC) has a Series A Term Sheet Template posted on their website for free. This term sheet is widely circulated within the VC industry for first-time founders and those interested in learning about VC investing.

Disclaimer: Wall Street Prep has no affiliation with Y Combinator or the NVCA.

Sample VC Term Sheet. Source: YCombinator

What is a term sheet?

Financial institutions issue term sheets to indicate interest in making a financial commitment. A lender might issue a term sheet when making a loan offer, or private equity fund might use a term sheet to lay out the provisions of a proposed acquisition. In venture capital, a VC fund issues a term sheet to a startup when it wants to make an investment in the business.

The venture capital term sheet explains to founders all the major details of the proposed investment, and kicks off a broader due diligence and negotiation process that will (ideally) conclude with an actual legal agreement to invest.

In this way, a VC term sheet can be thought of as the road map for what an eventual deal could look like. It’s largely nonbinding, meaning neither party (VC or founder) is committed to follow through on the proposed terms. A good term sheet should mitigate disputes between the two parties and help save time (and legal fees) in drafting up the actual investment documents.

Uses of a Term Sheet

The term sheet should cover the significant aspects of a deal without detailing every minor contingency covered by a binding contract. The term sheet essentially lays the groundwork for ensuring that the parties involved in a business transaction agree on most major aspects. The term sheet reduces the likelihood of a misunderstanding or unnecessary dispute. Additionally, the term sheet ensures that expensive legal charges involved in drawing up a binding agreement or contract are not incurred prematurely.

All term sheets contain information on the assets, initial purchase price including any contingencies that may affect the price, a timeframe for a response, and other salient information.

Term sheets are most often associated with startups. Entrepreneurs find this document crucial for investors, often venture capitalists (VC), who may offer capital to fund startups.

A term sheet used as part of a merger or attempted acquisition would typically contain information regarding the initial purchase price offer, the preferred payment method, and the assets included in the deal. The term sheet may also contain information regarding what, if anything, is excluded from the deal or any items that may be considered requirements by one or both parties.

Благодаря соглашению можно установить ясные правила поведения

В рамках соглашения можно определить такие правила, как взаимное уважение, вежливость, терпимость и справедливость. Они помогут создать комфортное и приятное взаимодействие между участниками.

Взаимное уважение: каждый участник должен проявлять уважение к другим участникам и их мнению. Это означает быть внимательным к собеседнику, слушать его и учитывать его точку зрения

Также важно избегать оскорблений и унижений

Вежливость: участники соглашения должны проявлять вежливость и корректность в общении. Это включает такие элементы, как поздороваться, поблагодарить, извиниться, выражать свою благодарность и т. д.

Терпимость: каждый участник должен проявлять терпимость и уважение к различию в мнениях и культурных особенностях других людей. Это позволит создать открытую и дружественную атмосферу.

Справедливость: важно, чтобы все участники соглашения были равноправными и имели одинаковые возможности. Необходимо избегать доминирования и избирательного отношения к определенным участникам

Благодаря джентльменскому соглашению и ясным правилам поведения участники могут создать доверительные и гармоничные отношения друг с другом. Они смогут решать конфликтные ситуации, а также совместно работать и достигать общих целей.

Нет сомнений в том, что джентльменское соглашение является основой для установления ясных правил поведения и создания дружественной атмосферы.

Chapter Title Goes Here

3. ВЫПОЛНЯЙТЕ должную дилижанс на инвесторов

При поиске потенциальных венчурных инвесторов не сосредоточивайтесь только на предлагаемом капитале. Исследуйте их портфельные компании и проверьте, имеют ли они опыт в вашей отрасли. Оцените их инвестиционную историю, экспертизу команды и их сеть связей

Важно найти инвесторов, чьи взгляды соответствуют вашему видению и которые могут принести стратегическую ценность вашему бизнесу помимо финансирования

4. НЕ ПРИБЛИЖАЙТЕСЬ к инвесторам без тяги

На сегодняшний день инвесторы ожидают видеть определенный уровень тяги перед предоставлением финансирования. Недостаточно иметь многообещающую идею; вам нужно продемонстрировать прогресс, будь то в виде выручки, роста пользователей, партнерств или достижений в развитии продукта. Инвесторы хотят видеть, что ваш бизнес может быть прибыльным.

Вопрос: Как стартапы могут получить тягу без начального финансирования?

Ответ: Стартапы могут получить тягу без начального финансирования, используя ранних пользователей, платформы краудфандинга или собственные ресурсы. Создание минимально жизнеспособного продукта и привлечение ранних клиентов могут предоставить доказательства спроса на рынке и привлечь интерес инвесторов. Кроме того, акселераторы и инкубаторы могут предложить менторство, ресурсы и связи, чтобы помочь стартапам установить свою надежность и получить тягу.

Chapter Title Goes Here

5. ПОНИМАЙТЕ значение сильной команды

Инвесторы часто ставят на первое место команду, стоящую за стартапом, вместо самой идеи. Команда с качествами, дополняющими друг друга и имеющая опыт выполнения задачи, демонстрирует способность преодолевать трудности и адаптироваться к изменяющимся обстоятельствам. Инвесторы хотят видеть команду, которая имеет как техническую экспертизу, так и деловые навыки, чтобы превратить идею в успешное предприятие.

6. НЕ недооценивайте силу рассказывания историй

Создание убедительной сюжетной линии вокруг своего стартапа является ключевым моментом для привлечения внимания инвесторов. История, которая эмоционально связывается с инвесторами и подчеркивает проблему, которую ваш продукт решает, может отличить вас от конкурентов. Используйте техники рассказывания историй, чтобы объяснить свое видение, показать потенциальный воздействие вашего решения и продемонстрировать, как вы уникально настроены на успех.

Вопрос: Какие советы для эффективного рассказывания историй в питче?

Ответ: Эффективное рассказывание историй включает в себя привлечение аудитории с самого начала, делает проблему понятной и четко артикулирует ваше решение. Используйте яркий язык, аналогии и метафоры, чтобы нарисовать картину в умах инвесторов. Подчеркните рыночную возможность и то, как ваше решение решает проблему или удовлетворяет потребности. Не забудьте передать свою страсть и энтузиазм по поводу того, над чем вы работаете.

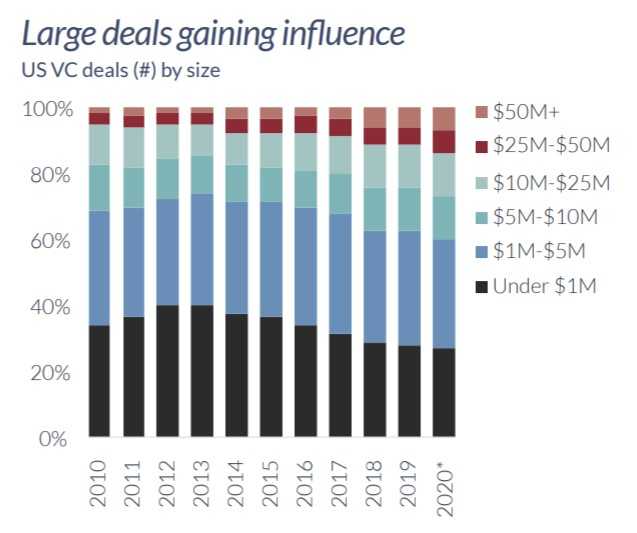

Funding Rounds in Venture Capital (VC)

A VC term sheet is created at each investment round, which is usually designated by a letter:

| Seed-Stage | Angel Round or “Family & Friends” Round |

| Early-Stage | Series A, B |

| Expansion Stage | Series B, C |

| Late-Stage | Series C, D, etc. |

Historically, deal counts tend to favor earlier stage investments as shown below. In the last few years, however, there has been a noticeable move towards deals of larger magnitude.

Deal Count by Size (Source: PitchBook)

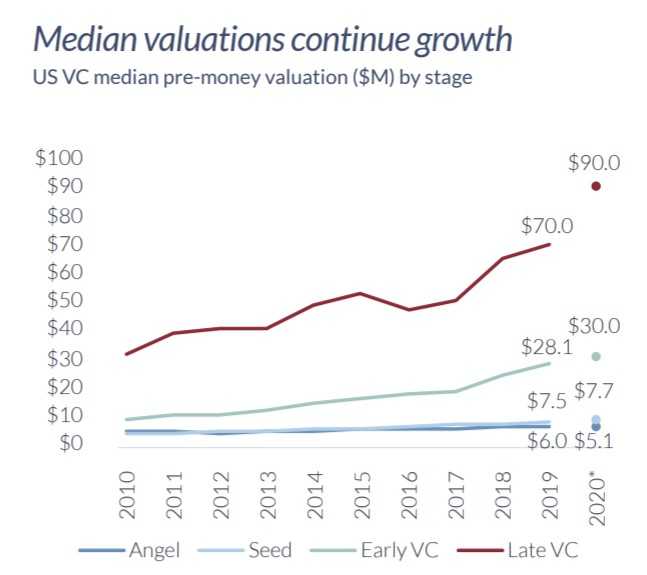

As you would expect, the average deal sizes are significantly larger for later-stage investments, but early-VC investments have been trending up across the board.

Median Valuations by Stage (Source: PitchBook)

Corporation: [Corporation Name]

Date:

This Term Sheet represents the

current understanding of the parties with respect to certain of the

major issues relating to the proposed private offering and does not

constitute a legally binding agreement. Except for the section

entitled «Binding Terms,» this summary does not constitute

a legally binding obligation. Any other legally binding obligation

will only be made pursuant to definitive agreements to be negotiated

and executed by the parties. This Term Sheet does not constitute an

offer to sell or a solicitation of an offer to buy securities in any

jurisdiction where the offer or sale is not permitted.

Pros / Cons of Fundraising

From the perspective of an entrepreneur and existing investors, there are several advantages and disadvantages of raising outside capital.

We have listed some of the most important considerations in the table below.

|

Pros |

Cons |

|

|

Entrepreneur |

Increased valuation if the company performs well, more capital to implement new expansion plans, access to experienced value-add partners |

Time-consuming process to raise funds (i.e. takes time away from managing the business) |

|

Existing Investors |

Control mechanisms (go or no-go decision) with options to double down or hedge risk, validation of the firm’s investment thesis |

Potential for ownership dilution, less voting power |

VC Capital Raising Timeline

While time to investment can vary from a few weeks to a few years, the venture capital timeline for an early-stage company has six discrete steps:

- 1) Start-up Formation: formulation of the idea, core team hiring, intellectual property filings, MVP

- 2) Investor Pitch: “roadshow” marketing of start-up, feedback on the idea, the start of diligence

- 3) Investor Decision: the continuation of due-diligence, final investor pitch, venture partner decision

- 4) Term Sheet Negotiation: deal terms, valuation, cap table modeling

- 5) Documentation: complete due-diligence, legal documentation, government filings

- 6) Sign, Close and Fund: fund, budget and build

What’s in a term sheet

Every term sheet is different, as every investment offer is different. However, every term sheet can largely be boiled down to a few categories of information:

Economic terms

Terms that influence the economics of a deal include:

- Investment amount: The proposed investment amount.

- Pre-money valuation: The valuation of the startup before any new financing. This number is key for founders, as it reflects what the investors think the company is worth. This valuation is entirely subjective, and is based off the investors’ due diligence.

- Share price: The value of the individual shares, as determined by the pre-money valuation.

- Post-money valuation: The valuation of the startup after receiving the financing, which dictates the investors’ ownership stake.

- Dividends: Details the income distributions investors are entitled to.

- Liquidation preference: Explanation of how the proceeds from a liquidity event will be distributed amongst investors. Generally, a 1x non-participating preferred liquidation preference is the standard. This means the investor is guaranteed at least 1x return on their investment in the event the company is liquidated or sold.

- Registration rights: These rights, if exercised by majority shareholders, can force a company to list its shares on the public market (i.e., file for an IPO) so that the investors can sell them.

Control terms

To protect their investment, VC firms often ask for some amount of say in the operations of the business. Terms that influence an investor’s control include:

- Protective provisions: Protective provisions give investors the power to veto certain business decisions they feel could jeopardize their investment. Protective provisions may come into play when a company issues new shares, amends its charter, sells the company, or changes the size of its board. They are some of the most heavily negotiated parts of a financing round, because they have an outsized impact on control of the company.

- Board seats: A lead investor may try to negotiate a seat on the company’s board of directors. The board of directors makes key strategic decisions on behalf of the company. Along with protective provisions, board seats help align the interests of the company with that of their investors.

- Anti-dilution provisions: How an investors’ ownership stake will be protected in the event the company sells new shares at a lower price than what the investor originally paid (such as in a “down round”).

- Drag along rights: A control term that allows majority shareholders to force the decisions of minority shareholders. This might include approving and participating in a sale of the company that is approved by the majority.

- Pro rata rights: Pro rata rights give investors the option to participate in future financing rounds (so as to maintain their ownership stake).

- Option pool size: Investors can influence the size of the employee option pool, which is the portion of equity reserved for a company’s employees.

- Right of first refusal: Provides investors the right to match any third-party offer on the shares of other key shareholders (i.e., management and founders).

- Information rights: Entitles investors to receive updates on the financial performance of the company, as well as access to the company’s facilities and personnel. Information rights are fairly customary in VC deals.

- No-shop agreement: A clause stipulating the founders can’t use the term sheet to leverage other investors into participating in the round.

- Exclusivity: A condition that requires founders not to talk to other investors for a stated period of time after the term sheet is signed (while the investors are doing their due diligence).

Investment structure

The investment structure details what is being purchased, and how.

- Investment instrument: Most venture investments are structured as equity investments or convertible debt. A convertible note term sheet will include a valuation cap, which is the valuation at which the debt will convert to equity. Alternatively, some early-stage deals are structured as SAFEs, which is an investment instrument used to expedite the fundraising process for pre-product or pre-revenue companies where a valuation may not be apparent. SAFEs are typically issued by the company in lieu of a term sheet.

- Share class: Most investors will ask for preferred shares. This class of shares comes with various rights and protections not afforded to other shareholders (founders and employees).

What Is a Term Sheet?

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents. Once the parties involved reach an agreement on the details laid out in the term sheet, a binding agreement or contract that conforms to the term sheet details is drawn up.

Key Takeaways

- A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made.

- Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

- The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

- Term sheets are also used for mergers, acquisitions, and long-term debt (i.e. commercial real estate development).

- Term sheets are non-binding, though may often require an upfront good faith deposit or other indicator of evidence that both parties intend to carry out an executed full agreement.

Tips for Writing a Term Sheet

Every term sheet will vary, as the parties, conditions, situation, and agreement will rarely be repeated. Still, there are broad tips to drafting a term sheet that apply to nearly every situation:

- Summarize the Conditions. At the beginning of the term sheet, draft a summary that identifies the overall purpose of the agreement and intended outcome. This includes specifically addressing the project (i.e. Seed A funding of Company XYZ or Residential Development of 254 units in Los Angeles, CA). Identify each of the legal parties to be involved.

- State Binding/Non-Binding Terms. A term sheet should explicitly state expectations regarding whether the agreement is binding or non-binding. This is often listed early in the term sheet.

- List the Terms. Though straightforward, understand that a term sheet is the first piece of formal transparent information the opposing party may receive. Though the term sheet should not be the full list of details in the agreement, be mindful to provide enough information to entice the other party without being too overwhelming with details. The term sheet should cover the primary, most important aspects of a deal with the understanding that the minor aspects can be sorted out later.

State Timeframes. Though the term sheet is non-binding, it should still come with an expiration date that requires the opposing party to take action by a certain time. This will not only encourage participation and action on the term letter but also ensure the terms of the deal do not become stale and unfavorable if held open for too long.

Encourage Feedback. Consider distributing a Word document version of the term sheet that tracks changes. It would be ideal if the first draft of the term sheet was a complete meeting of the minds with no further changes. Realistically, this is rarely achieved. Though you must ensure the other party does not make changes without tracking, tracking changes allows each side to easily identify the areas not yet in agreement.

A company will often solicit multiple term sheets and compare the terms across bidders. It will then likely move forward with the term sheet that is most favorable, though it may decide to negotiate with anyone that submit a term sheet.

Similar Documents to Term Sheets

A term sheet may seem similar to a letter of intent (LOI) when the action is predominately one-sided, as in acquisitions, or a working document to serve as a jumping-off point for more intensive negotiations. The main difference between an LOI and a term sheet is stylistic; the former is written as a formal letter while the latter is composed of bullet points outlining the terms.

Although term sheets are distinct from LOI and memorandums of understanding (MOU), the three documents are often referred to interchangeably because they accomplish similar goals and contain similar information.