Frequently Asked Questions

Like most other legal agreements, terms set out in a term sheet may be modified at any time prior to signing the final funding agreement. Remember that, with the exception of exclusivity and (possibly) confidentiality clauses, all contents of a term sheet are non-binding. You will likely be negotiating with your prospective investor until either the parties reach a final agreement or until the time limit date stated in the term sheet is reached.

Can a term sheet be canceled?

If you find that your are no longer interested in having an investor invest in your company, you may be able to contact that investor and cancel your negotiations prior to the final date stated in the term sheet. Keep in mind, however, that the investor may still hold you to the exclusivity clause in the term sheet, preventing you from meeting with other investors until the stated expiration date.

Example of a Term Sheet

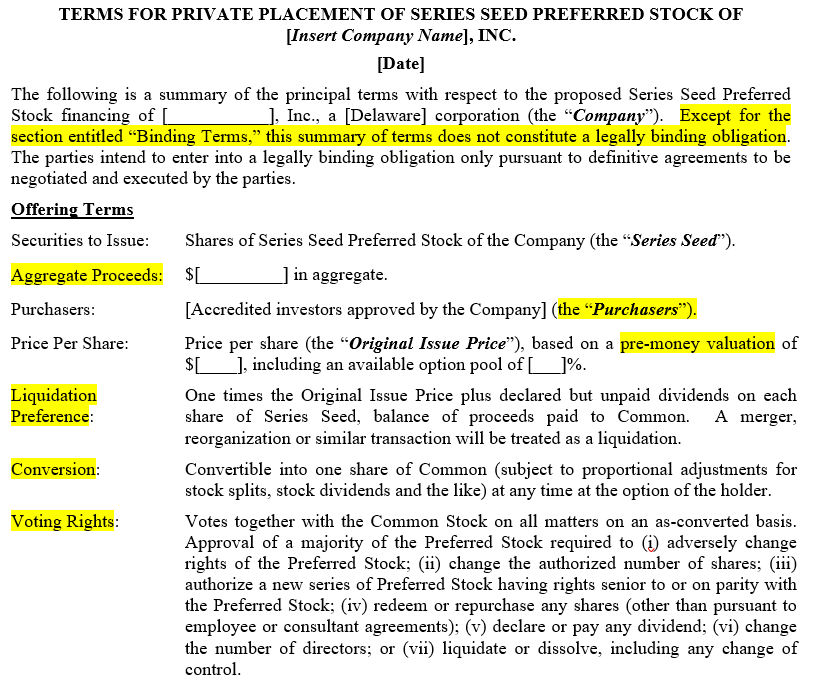

To help build understanding of term sheets, example templates can be downloaded from organizations such as Series Seed or NVCA. Shown below are screenshots of the Series Seed Term Sheet template, with some key terms highlighted followed by some context and explanation.

The image shown above is the first half of the Series Seed Term Sheet template. Highlighted terms are discussed below:

- Non-binding agreement means that apart from the specifically listed “Binding Terms”, the document is not legally binding.

- Aggregate Proceeds means the total amount of funding that must be raised in this round in order for the deal to proceed.

- Purchasers identify the investors.

- Pre-money valuation defines the value of the company prior to this investment.

- Liquidation Preference specifies the rights of the investor to liquidation preferences and the multiple.

- Conversion specifies the investor’s rights to convert preferred stock to common stock.

- Voting rights outlines the rights of the investor to vote on decisions regarding the company structure, company operation, future investment, etc.

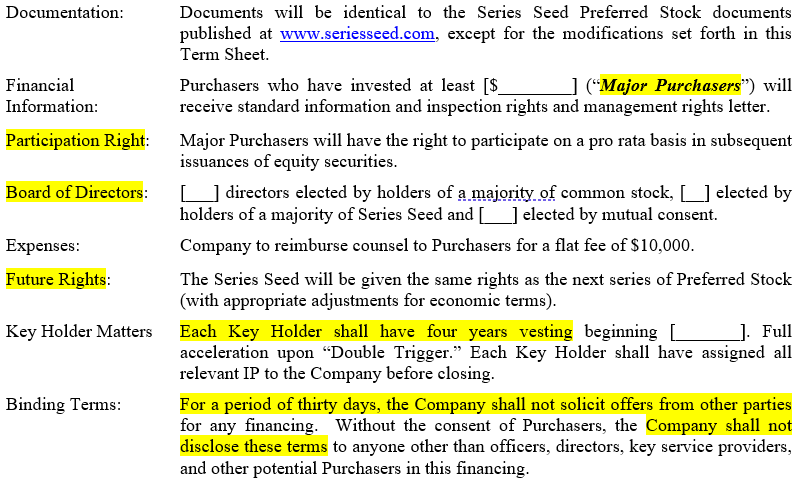

The image shown above is the second half of the Series Seed Term Sheet template. Highlighted terms are discussed below:

- Major Purchasers could be the lead investor and other significant investors with special rights.

- Participation Right lays out the pro-rata rights in this instance. It specifies that the investor will have the right to invest in future rounds an amount proportional to their current holding percentage..

- Board of Directors sets out the rights of the investors regarding the election of directors.

- Future Rights specifies the rights and entitlements of current investors in future funding rounds.

- Key Holders are investors named in the share register who hold a large number of shares or hold stock with particular rights or stock options. Usually these are the founders.

- Binding Terms lists terms such as exclusivity and confidentiality that are legally binding, even if the term sheet as a whole is non-binding.

Pre-fundraising: Initial Homework

Before going into the details of the term sheet clauses, it first makes sense to highlight some of the initial groundwork that needs to be completed. Below are the areas that I find myself most-often counseling entrepreneurs on when asked for fundraising advice.

Figure Out Vesting

Internally, before entering negotiations with outside investors, make sure to put in place an appropriate vesting schedule. A sudden departure of a founder with vested stock leaves dead-equity on the cap table, which can have important implications on the efforts of the remaining founders. Here’s a good guide to get you started on the subject.

Get Your Investor Ducks in a Row

Getting two independent term sheets at the same time is an excellent way of processing your value. You can compare the two in isolation and get a more rounded view of how investors are appraising you. Also, if one investor sees that you’ve put all of your proverbial eggs into their basket, it may turn the screw on certain negotiation elements.

Adapt to Mismatched Investors

If a startup raises a seed round from a renowned angel or early-stage VC fund, then it’s going through a well-oiled machine and surprises should be unlikely. Conversely, if an opportunistic late-stage private equity investor or new-to-the-game corporate is investing, then there may be more legal points to iron out if it is trying to port over a term sheet normally used for other kinds of deals.

Do Your Own Due Diligence

With regards to your investor(s), view the process as a two-way due-diligence exercise. Their credentials should be assessed beyond how deep their pockets are. Choosing your investors means choosing long-term business partners who play a fundamental role in the development of your business. So make sure to do your homework. Here’s a useful article to get started.

Be Smart About Your Valuation

The concepts of pre-money and post-money valuation are required learning for anyone raising money. A slip of the tongue between either can be material in terms of ownership percentages and economics.

Be aware of how your valuation is benchmarked against other companies. A high valuation can certainly show some external validation and stronger paper wealth. However, it also raises the bar for your performance levels if you want to get to a future round, a situation also known as the “valuation trap.”

Get Neutral Advice

Finally, in relation to other external parties, contract a lawyer with a track record in this area, and make sure to take your own decision on who to hire. Don’t necessarily choose your investors’ recommendations. This article offers some useful insights into tackling the legal side of things.

Should You use Term Sheets?

Although in most cases, it is the investor that will present you with a term sheet regarding investment in your company, it is important to recognize that you do not have to wait until this happens. You are fully within your rights to draft a term sheet of your own. Just be sure to consult with an attorney when drafting your company’s term sheet. Here are some tips for when to, and when not to, use a term sheet:

|

Use a Term Sheet: |

Avoid Use of a Term Sheet: |

|

When you are a first-time business owner uncertain about how to proceed to secure funding. |

If your goal is to determine what several investors may offer you for an investment. |

|

When you lack experience with venture capital firms. |

When privacy regarding potential investments is not important. |

Get a good lawyer in your corner

As you gear up for negotiations over your term sheet, remember this: VCs write them for a living and have negotiated tons of deals; as a startup founder, this may be your first rodeo. Don’t go it alone.

“Have a good lawyer,” Beebe recommends. And while you should understand every deal term, you shouldn’t negotiate every one. “Learning when to give, and when to dig in is probably the biggest set of learnings I had from those early negotiations,” he adds.

Like in any negotiation, leverage is key — and you should understand the leverage you do or don’t have before you sit down to discuss term sheet details. “The vast majority of the work to be successful in a term sheet negotiation comes well before that,” says Richard Matsui, founder and chief executive of kWh Analytics, a San Francisco startup that provides risk management services for investors in solar projects.

That, adds Matsui, means having a clear understanding of your startup’s strengths and weaknesses, gauging overall investor demand and having a compelling story to tell.

Pay attention to pay-out provisions

Liquidation preferences are provisions attached to preferred stock that help VCs protect their investments, especially in situations where a startup has a middling exit, or worse. Many first-time founders fail to fully grasp their importance. “There were concepts that it took time — and two startups — for me to fully grasp,” says Tellerman. “The first was liquidation preferences. It is critical to understand the scenarios around who gets paid, in what order and with what multiple when you exit.”

The terms used in liquidation preferences are arcane and include non-participating preferred, capped participating preferred and uncapped participating preferred.

Behind the legalese are provisions that determine how much money investors — and thus founders, employees and other shareholders — will receive if the startup is sold. Tellerman strongly advises founders to negotiate for so-called 1x liquidation preferences. (A more detailed look at how liquidation preferences can affect your startup is available here.)

What’s Included in a Term Sheet

The details to be included in a term sheet are highly dependent on the agreement at hand. What is included in a angel investment, early funding investment term sheet will be substantially different than what’s included in a commercial real estate development term sheet.

Regarding an investment term sheet, commonly included details are:

- Nonbinding Terms. Neither party is legally obligated to abide by whatever is outlined on the term sheet.

- Company valuations, investment amounts, the percentage of stakes, and anti-dilutive provisions should be spelled out clearly.

- Voting rights. Startups seeking funding are usually at the mercy of VCs who want to maximize their investment return. This can result in the investor asking for and obtaining a disproportionate influence on the company’s direction.

- Liquidation preference. The term sheet should state how the proceeds of a sale will be distributed between the entrepreneur and the investors.

- Investor commitment. The term sheet should state how long the investor is required to remain vested.

Regarding debt agreements, commonly included details are:

- Economic details. This includes the term, loan size, interest rate, and other financial matters common to debt.

- Risk mitigation preferences. The lender will often require specific conditions be met or specific information be provided on a recurring, timely manner.

- Extension rights. The borrower is often allowed to extend a loan, but the term sheet identifies the conditions and cost of extension.

- Due diligence at closing. As part of the term sheet, the lender may stipulate what they require when the loan agreement is drafted. This can include a list of requirements the borrower must prepare to be approved for the loan.

A term sheet may be signed by both parties to formally signify that each side has agreed to the terms and that each team’s legal council may proceed with drafting a formal agreement.

Options pool, liquidation preferences and board seats

For instance, the size of a stock option pool set aside to reward employees and attract future recruits and advisors is a fundamental variable that should be carefully thought through. A larger option pool will further dilute the founders’ ownership share, though by how much depends on the company’s valuation relative to the investors’ stake.

“I prefer to discuss as many key terms as possible during the term sheet stage — or even before if the investor is asking — to help ensure both parties are on the same page,” says Shanna Tellerman, a serial entrepreneur and founder and chief executive of Modsy, a startup whose 3D modeling software lets customers design and furnish their living spaces. Tellerman says that besides investment amount and valuation, founders should focus on the option pool, liquidation preferences and board seats handed out to investors. “With this baseline agreed upon,” she says, “much of the deeper negotiating becomes easier because you are on the same page for the key terms.”

Investor Rights in Term Sheets

Investor rights play a part in both the economic and company control subject matter of a term sheet. Three investors rights issues typically included in a term sheet are:

-

Pro Rata Rights : the right of an investor to participate in additional funding. This allows the investor to maintain the same level of ownership in a company when further funding is sought. Pro rata rights are usually good for the company in that they provide a level of security regarding future funding.

-

Voting Rights : the right given to a shareholder to participate in decisions made by the company. In most cases, voting rights are vested only in common stock shareholders. While preferred stock owners (most venture capitalists) do not generally have voting rights, they may nevertheless insist on a say in board decisions.

-

Information Rights : refers to information that a venture capital investor requires be provided to it by the company on a regular basis, including financial statements, budgets and other documents. The right to physically visit the company from time to time may also be included.

Legal Fees

In most cases, an investor will require the company to pay certain legal fees associated with a venture capital deal.

Confidentiality Clauses

Term sheets typically include a provision that prohibits the founders from from discussing the terms of the proposal with anyone other than co-founders and legal counsel.

Miscellaneous Provisions

Term sheets will additionally include standard “representations and warranties” language, as well a stated date for closing the deal.

Other important financial and company control issues may be addressed in the language of a term sheet. It is therefore critical that you have a skilled attorney review all aspects of any term sheet you consider before you agree on a deal with an angel investor or venture capital company. The successful future of your company depends on it.

What to be Wary of in a Term Sheet

While a term sheet is generally non-binding, it is important to still be cautious of terms that might be included in a term sheet that may not be in the best interests of the company. Such terms could include:

- Participation rights: Holders of preferred stock may be allocated participation rights enabling them to first receive their liquidation preference, and then, in addition, participate in the deal as a common shareholder. This is commonly termed ‘double-dipping’.

- Large controlling stake: A stake in the company may be large enough to give an investor a controlling interest. This becomes especially tricky if the investor is a large corporation.

- Short timeline: A very short expiration date or “exploding deadline” can be used as a pressure tactic by investors to force the hand of a founder and discourage them from seeking funding elsewhere.

- Unfair financing: Funding conditions that place too much pressure on a company’s operation and ability to repay financing.

- “No-shop” clause: This refers to an exclusivity requirement that prevents a company from “shopping around” for other investors. This period should not be too long.

- Limiting terms: These terms may limit the potential for future fundraising.

Term Sheet FAQs

The following lists some frequently asked questions regarding term sheets:

Why are the terms important if they are non-binding?

While terms in a term sheet may be non-binding, they still represent the conditions of an agreement that both parties have agreed in-principle, like a handshake deal. If the due-diligence progresses well, these are the terms according to which a binding stock purchase agreement will be prepared.

Is a term sheet legally binding?

Unless noted otherwise, a term sheet as a whole is not legally binding. However, some specifically identified terms within a term sheet are legally binding, such as exclusivity periods and confidentiality.

Who prepares the term sheet?

A term sheet may be prepared by either party – the investor or the founder. Usually, if a venture capital firm is investing, the VC offers a term sheet.

What makes for a good term sheet?

A good term sheet should be clear, concise, include all the important terms of the agreement, and be clearly understandable without excessive detail. As with any investment, doing your due diligence is critical, and understanding terms sheets is an important part of that process.

If you would like to know more about investing in startups, you can find more information here on how to start angel investing and how to find opportunities for angel investing on Propel(x).

Common Elements of a Term Sheet and What Should be Included

Term sheets vary depending on who prepares them and according to the preferences and objectives of those involved. As a guide, a term sheet should include the following items:

- Valuation: This figure shows the value of what the company is deemed to be worth and will often include the “pre-money” valuation (prior to investment) and / or “post-money” valuation (equal to the pre-money valuation plus the investment funds).

- Identification: Details of the parties involved in the deal.

- Percentage stake: The percentage of the company that the investor will own once the financing is complete.

- Investment amount: The amount being invested by the investor named in the term sheet.

- Aggregate proceeds: The total amount to be raised in the funding round from all investors. For example, a lead investor might take a major portion, say 50% of this figure, but the founder may need to source the remaining investment funds from smaller investors.

- Major investor status: The lead investor and other significant investors may be specifically listed as major investors with special rights such as information rights, pro-rata rights etc.

- Voting rights: This will describe any special rights an investor may have to vote on key decisions affecting the company operation and structure.

- Board of directors: An investment may require the creation of a board of directors if one is not already established, and major investors may specify a requirement for a board seat.

- Liquidation preference: This specifies the rights of an investor in case of a liquidity event. We have written extensively about liquidation preferences earlier.

- Option pool: Specifies the percentage of company shares that are reserved for company employees or key stakeholders.

- Timeframe: This will set the time period for expiry of the term sheet offer, and (if applicable) the exclusivity period nominating how long the company must not seek funding from other parties.

- Other provisions: Any other miscellaneous items such as responsibility for legal fees, information rights, non-disclosure requirements, etc.

Terms Found in a Term Sheet

Term sheets often have standardized language that is commonly and widely accepted by both parties. Here are some specific terms or phrases found in two different types of term sheets.

Investment Term Sheets

Valuation (Pre-Money & Post-Money): Investors may want to see the pre-money valuation and post-money valuation before an official investment agreement is drafted. This valuation information should be based on what the valuation is before the investment is made as well as the value of the company including the new investment.

Valuation Cap: The valuation cap is the value when convertible notes become eligible to covert into equity. Often an important negotiation point, this figure must be discussed early between the two parties to understand a fair point for the start-up to engage in a proper valuation and what protection is fair for the investor.

Drag Along Clause: Investors may want guarantees that minority stakeholders will follow the guidance of majority stakeholders. A drag along clause requires that smaller investors lead larger investors in business decisions.

Dividends: Investors may want upfront clarity on what net income distributions they will be entitled to. In addition to clarifying the dollar amounts, investors may want to know the timing (i.e. monthly, quarterly, or annual).

Liquidation Preference: Investors may want to know the order in which owners are paid out in the event the company gets sold. This is important to investors as it reduces investment risk.

Voting Rights; Investors may be interested in the say they have over the operations of the company. This may be an agreement on the number of votes the investor receives or any restrictions on matters in which they are not eligible to vote in.

Pro-Rata Rights: Investors may want to better understand their rights for future rounds of investing. For example, depending on their current investment, they may be entitled to the right of first offer for an investment offering in the future. On the other hand, there may be penalties for investors that decide to not partake in future rounds of investing.

No-Shop Agreement: Investors may want protection from other investors or other investment rounds. A no-shop agreement outlines the terms that restrict the company from taking investment money from other people for a specific period of time.

Loan Term Sheet

Loan Amount: Borrowers are obviously pursuing a specific amount of funds to borrow. This term may be a fixed dollar amount, subject to LTV metrics, or subject to DSCR and NOI calculations.

Guaranty: Borrowers may be required to indicate what legal entity with more established credit may vouch for the debt and be held liable in the event that the direct company defaults.

Interest Rate: Depending on the loan, these terms may widely vary. For long-term loans, the interest rate may include a fixed spread rate in addition to a variable rate (i.e. one-month term SOFR).

Term: Borrowers must understand when the loan is fully payable or due. For open lines of credit or development loans, this is the period in which the loan is assessed interest but principal payments may not be due.

Collateral: Borrowers may have to post collateral to substantiate value in the event that they default on a loan. This is often the underlying asset that is supported by the debt, and the lender often stipulates whether they require having the first deed of trust.

Financial Covenants: Borrowers may have to substantiate financial health to a lender. This includes providing externally certified financial statements, guarantee statements, or other financial records that are in accordance with covenants agreed to with the lender.

Loan Costs: In addition to interest assessments, a lender may require an annual administration fee or a one-time loan closing fee. For very large loans, these expenses may be material, and the lender should take care in reviewing what upfront costs must be paid before any loan proceeds are distributed.