The Compelling Latin America Opportunity

Nubank is trying to be the go-to financial company for everybody in Latin America which is a compelling market for a few reasons:

A. The market is significantly underpenetrated

Due to low levels of financial inclusion and high costs, many people in Latin America remain unbanked, which Nubank can address.

-

Brazil: 30% of the 169M people over 15 didn’t have a bank account

-

Colombia: 55.1% of the 40M people over 15 didn’t have a bank account

-

Mexico: 64.6% of the 96M people over 15 didn’t have a bank account

That accounts for over 130M people by itself that remain unbanked.

B. A concentrated sector with low innovation historically

The banking sector is highly concentrated with five largest banks controlling ~70-85% of the market in these countries.

Given the high concentration, the customer experience has typically been poor, the fees have been high and the lack of competition has resulted in a lack of innovation.

C. High costs to serve which make it ripe for disruption

The incumbent banks have high costs to serve given their large branch footprints and their large workforces. In Brazil for example, these banks have over 80,000 employees each and ~2,000-5,000 branches.

This results in high costs, which are typically passed on to the customer in the form of fees.

In many ways, this is a market where the value proposition and need for an alternative was extremely high, much more than some places such as the US, where the underbanked population is relatively small, and while the existing banks are not digital, do compete relatively fiercely with each other (at least for certain segments of customers).

Business Model

So how does Nubank make money?

At a high level, their business model is not dissimilar to any other bank, except they don’t tend to charge many types of fees (such as to maintain a debit card / credit card, etc.) and takes two main forms:

-

Interest Income (~55% of revenue): Interest income is primarily generated on credit cards and loans, followed by other interest income on financial instruments (deposits and govt bonds)

-

Fees (~45% of revenue): The main driver of fees are interchange fees which are earned on the volume processed by credit cards and debit cards. This is followed by smaller sources of fees from recharges, rewards and late fees as well as other commissions on life insurance products and similar.

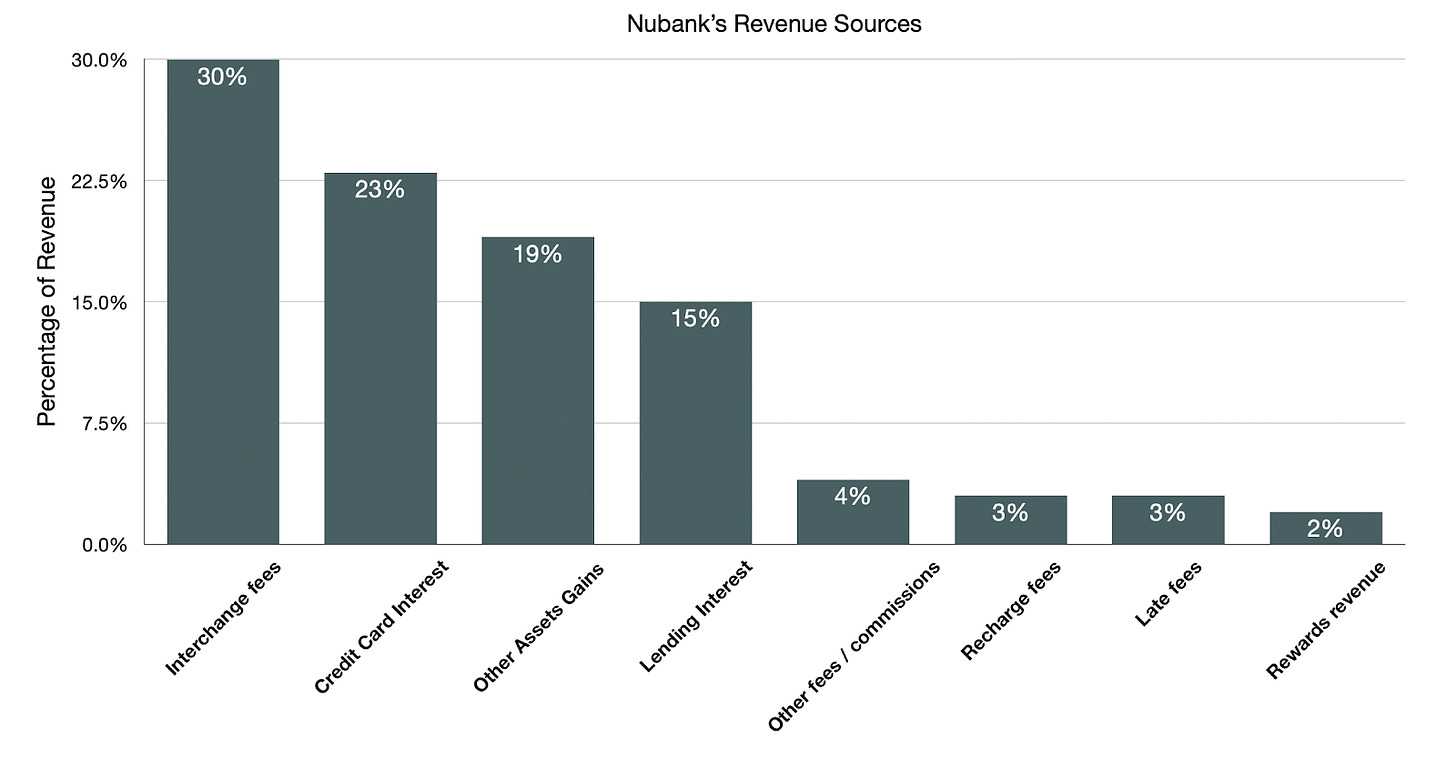

The chart below highlights these sources of revenue, based on 2021.

Source: Analysis of S-1 financials

A couple of points are worth noting:

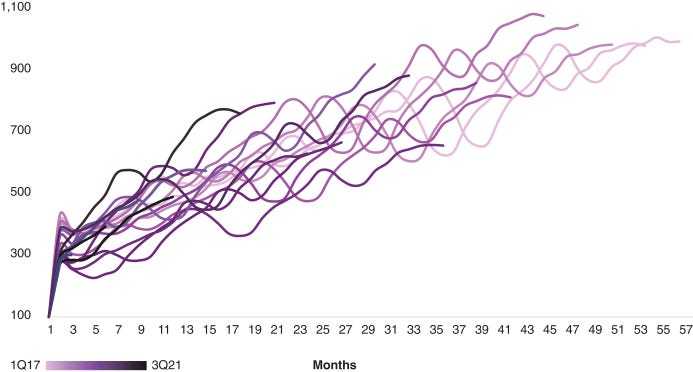

Interchange fees: Interchange fees are the largest revenue stream representing 30% of revenue and are directly related to the purchase volume on cards which grew almost triple digits to $30B so far in 2021. The current net interchange fee rate is 1.1%, and Nubank is already processing almost ~10% of all credit card volume in Brazil. As in the chart below, the monthly average purchase volume by cohorts has been trending well.

Monthly average purchase volume by cohort

-

No fees on many products: Nu does not charge fees on many products such as their core credit and debit card, their mobile payments products and their personal and business accounts. In some ways they are definitely under monetizing relative to competitors but at the same time this is their differentiator and driver of low-cost acquisition and customer growth.

-

Interest earning portfolio: Interest income from loans and credit cards is highly dependent on the volume of the interest-earning portfolio. That number has grown remarkably between 2020 and 2021 (over ~250%) and stands at over $1.4B.

-

Deposits: Deposits is another key metric since its growth represents $ which can earn a spread for Nubank (and also be lent to other customers). As customers have grown and as they have grown their usage of Nubank, deposit growth has been fairly high, typically in the triple digits. As of Sep 2021, Nubank has over $8B in deposits, ~$168/customer.

Revenue per customer

The upshot of all of this is that Nubank generates a revenue of ~$4.9 in monthly average revenue per active customer. This number has been growing over the past year (~25% y/y) as users attach to more products and start using Nubank for a greater share of wallet. However, in general, newer users have lower Monthly ARPACs, and so an increase in customer growth has also meant that this number faces downward pressure.

Incumbent banks have monthly APRACs of $38, which is roughly ~8X that of Nubank’s. Given Nubank’s lower fees, while they might not reach that level, there is significant room to grow ARPACs by focusing on:

-

Increasing penetration of existing products and share of wallet within existing customers

-

Cross-selling additional products to existing customers

There are signs that Nubank is able to do both of these.

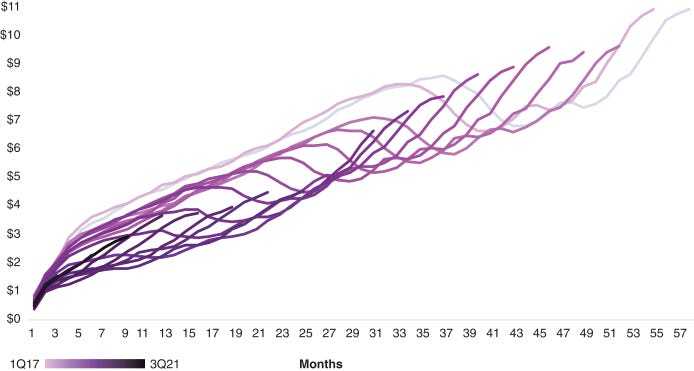

Firt, based on the cohort data, monthly ARPAC has increased as customers age and adopt new products and increase share of wallet, as below.

Monthly ARPAC over time by cohort

Second, Nubank has been able to cross-sell products such as personal loans to customers, and the set of customers who were active across their core products, which include credit card, NuAccount and personal loans had Monthly ARPACs in the US$23-US$34 range.

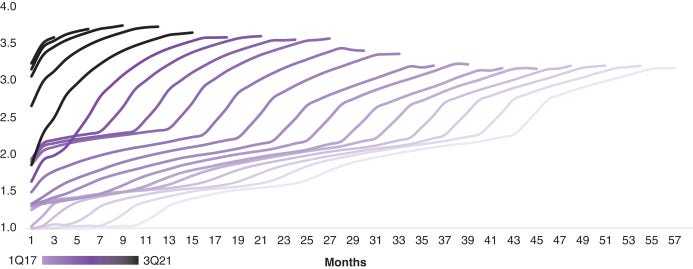

Over time, users have been using more products, right from the get go and as they age, as below.

Number of Nubank products used over time by cohort

If you don’t receive insights from our network of advisors, please sign up and join a global community of builders:

Make sure to also check the newsletter from Tanay, one of our advisors.

GTM and Customer Acquisition

David Velez, the founder of CEO of Nubank, on a podcast with Patrick O’Shaughnessy said that one of the key bets of Nubank was to create a great product with no fees, and hope that the better pricing and product meant that they could acquire customers more cheaply than incumbent banks.

That bet worked remarkably well and Nubank hasn’t changed their core ethos much. The focus has been on a great product with great pricing which in some ways basically sells itself.

At a high level, the GTM approach of Nubank is to focus on being a great all-digital cloud-based bank which reaches customers by:

A. Prioritize high-quality customer experiences to drive organic word-of-mouth advertising and customer referrals

Between low fees and a great product, Nubank has focused on a “member-get-member” marketing strategy where delighting customers leads to them referring their friends and family to Nubank/

In a generally competitive fintech market where CACs continue to rise, the fact that Nubank has created a product where 80-90% of customers per year are acquired organically through word-of-mouth or unpaid referrals is quite remarkable.

B. Social Media and Content Marketing

Nubank has maintained a strong social media presence to drive awareness and engage with customers. They have ~9.6M followers across their channels today.

They have also partnered with selected influencers such as Brazilian pop star Anitta.

Lastly, they have focused on creating educational content to strengthen their brand and attract new customers. This has helped them rank highly in search engines for key topics and drive 110M+ organic visitors in aggregate over time. In addition, their financial education newsletter has over 2M subscribers!

In aggregate, Nubank is spending less than 5% of their total revenue on marketing, and approximately ~4X that on R&D in developing a great product, and ~3X that in providing great customer support.

NuCoin + CBDCs in Brazil

In partnership with Polygon, NuBank is launching a blockchain-based token in early 2023.

The strategy to beta test in the community makes a lot of sense. Because the token will be free floating, there is a profit incentive for those who participate, a practice that is in line with most other major token launches.

Brazil’s Central Bank also recently announced they will be piloting their own Central Bank Digital Currency (CBDC) in 2023, with a target rollout of 2024.

The two are completely different:

- Nucoin is a free-floating token that trades more like Bitcoin (ie. highly volatile)

- The Brazilian CBDC is more like a stable coin, and is pegged to the BRL (Brazilian Real)

In line with the Future Banking Business Model, there seems to be an inevitability to ‘Blockchain Banking’ making its way into not just the Brazilian market, but the global market, here in the near future.

Markets like Brazil and Mexico are still heavy cash-based societies, so it is not like cash is going anywhere. But these types of models have multiple complexities, especially given that merchants bear the cost of transactions, not consumers. In Brazil, this is evidenced with their Pix money transfer system.

The Brazilian CBDC may remove the MDR (Merchant Discount Rate) fee for merchants, meaning Pix will increase even more in popularity (in theory). Naturally, Nubank integrates with Pix, but it is going to be interesting to see how NuCoin performs in this mix going forwards. On the surface, it looks like a new free-floating system of Rewards, incentivizing both retention and engagement.

But in a world of localized CBDCs, will it actually be a competing coin?

Seems unlikely, but it is always hard to predict how these types of innovations will perform in emerging markets. Especially since Nubank has more than 65 Million Brazilian users going into 2023.

Nubank — Founders and Team

The founders of the company are David Vélez, Edward Wible and Cristina Junqueira.

- David Vélez is the founder and the CEO of Nubank. He was a board member at Despegar.com. He was also a partner at Sequoia Capital. He was the senior associate at General Atlantic. He began his career as an analyst at Goldman Sachs. He pursued his education from Stanford University.

- Edward Wible is the founder and the CTO of Nubank. He is a graduate in Computer Science from Princeton University.

- Cristina Junqueira is the co-founder of Nubank. She began her career from Boston Consulting Group. She has got a bachelor’s and a master’s degree in engineering from the University of Sao Paulo.

Cristina Junqueira, Edward Wible and David Velez (left to right), Founders, Nubank

Cristina Junqueira, Edward Wible and David Velez (left to right), Founders, Nubank

Key things to watch going forward

-

Nubank’s market share in Brazil is massive, so expecting a double digit growth for a prolonged period of time in company’s home market is unreasonable. Therefore, company’s ability to scale in Mexico and Colombia are critical for further growth.

-

The interest Nubank’s lending portfolio is generating does not cover the cost of deposits and provisions for credit losses. Thecompany is yet to prove it can scale its lending business profitably. Interest income is the bread and butter of commercials banks after all.

-

Revenue from recently launched services (insurance, brokerage) and SME customer base is non-essential at the moment, and most of the non-interest income is generated by the card issuing business. Upselling the existing customer base with premium services will clearly be a driver for further revenue growth.

-

The company closed its first trading week with the market cap of over $54B, so I am curious how far it can go (as mentioned, Nubank is already the largest bank in Latin America by market cap). I have no doubt that Nubank will be able to execute on both, expansion to other geographies and better monetization of the customers in Brazil. However, we are yet to see if this will drive further the market cap, or rather justify the existing price tag.

On the final note, for anyone interested in Nubank’s story, I would recommend listening to Patrick OShaughnessy’’s conversation with David Vélez, the company’s co-founder and CEO. I always find it useful to hear the motivation of the founders and if they still are on the mission to make an impact.

Thanks for reading Popular Fintech! Subscribe for free to receive new posts:

Sources used: company’s F-1 filling, Nubank’s website and Yahoo Finance. Other sources are linked directly in the text.

Disclosure & Disclaimer: I have open positions in most of the FinTech company I write or plan to write about, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice.

Thanks for reading Popular Fintech! Subscribe for free to receive new posts and support my work.

Nubank obtained 7.4 billion information requests

According to data from the Open Finance governance structure, Nubank obtained over 7.4 billion information requests from other Brazilian institutions, accounting for 46 percent of all communications. In contrast, the country’s largest traditional bank, Itaú, received only 23 percent.

The digital approach taken by Nubank reflects its proactive efforts in the adoption of the Open Finance framework. Neobanks, being newcomers in the banking sector, naturally leverage this system more extensively than well-established banks, which have already secured leadership positions. Fintechs have recognized the value of accessing relationship data to better understand customer habits, driving them to be more active in attracting customers to the ecosystem.

Nubank is using the Open Finance framework to enhance its credit assessment capabilities for card transactions and personal loans. With over 75 million customers in Brazil, Nubank’s expansion into the loan segment aims to increase profitability. The bank has invested in sophisticated data infrastructure and artificial intelligence strategies, giving it unique credit underwriting and financial services capabilities.

BANKING and fintech IN BRAZIL

In South America’s largest country, close to $190B (BRL 817B) is moved annually within its banking system. There are 55M people without banking access — the majority from the poorest areas. The financial institutions in Brazil are criticized for the profit margins they make on fees and interest revenue (higher than banking in US and Europe), and lack of industry competition in the region. The top 5 largest banks (Itau, Banco Santander, Bradesco, Banco do Brasil, and Caixa Economica) oversee over 80% of banked assets in the country.

For those who do have banking accounts, they walk into a highly-guarded bank branch with double doors to see a teller. The overall service experience is cold and uncomfortable. This is a leading factor in 45M banking customers having inactive accounts (i.e. no transaction activity in the last 6 months), per Instituto Locomotiva.

Similar to other developing countries, most of the population (about 85%) has a mobile phone. Internet usage and access is also high for Brazil at 70%. The combination enables a huge market for innovative mobile banking and FinTech applications to become solutions with mass adoption. The country’s estimated rate of fintech adoption in 2019 was 64%, up from 40% in 2017.

As the leading FinTech hub in Latin America, Brazil has over 500 startups in its ecosystem. Half of these companies doubled revenue growth last year, and raised nearly 60% of venture funding in LATAM for 2018.

Over 200 of these fintechs are expected to bring $12B+ in revenue by the end of the decade — many of them focused on payment processing. The country is truly set to continue its leadership throughout the region over the long term.

Nubank Outlook – 2023 and Beyond

Nubank’s stock (Ticker: Nu) was down 59.2% in 2022, which isn’t great. All the consumer-facing Digital Banks got hammered in 2022, the majority worse than Nubank. The company still has a market cap of nearly $20 Billion, however, keeping it in the top-tier of Digital Banks globally.

They come into 2023 with roughly:

- 66 Million+ users in Brazil

- 3.5 Million+ users in Mexico

- 0.5 Million+ users in Colombia

By many standards – despite the 60% haircut – Nubank had a great year in 2022. Especially when you look at the performance of some of the ‘next-gen’ credit players in the BNPL market like Klarna (private) and Affirm (public), who were down approximately 85% and 90% respectively in 2022. Ouch!

In an Outlook type mindset, however, we have to look at what looks good for Nubank, and where the risks are entering 2023.

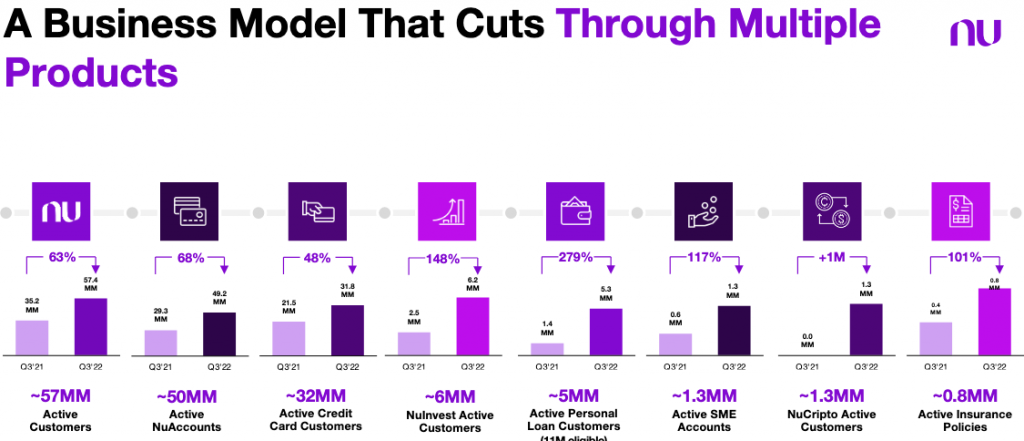

Nubank Business Model – Investor Presentation

Despite being heavily leveraged towards credit, they have started diversifying their business model across multiple products including investments, business accounts, cryptocurrency trading, and insurance. That’s a positive.

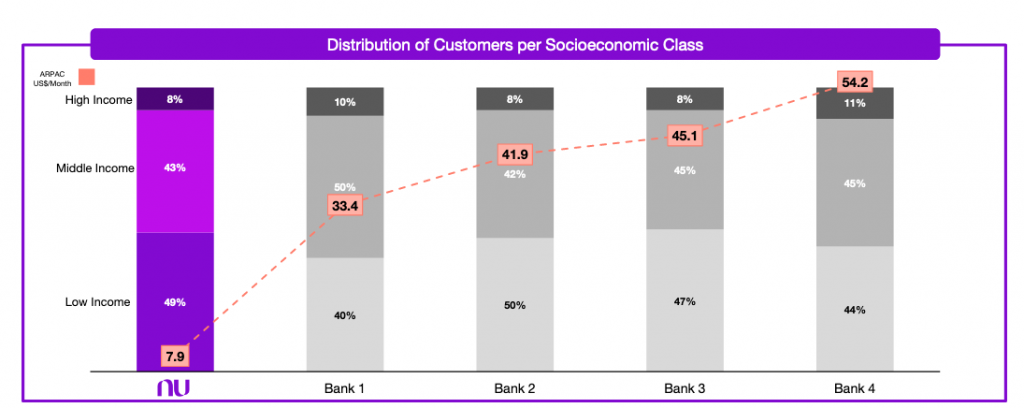

Credit Portfolio & NPL Risks

The risks lie in the credit card business. Any type of model where you lend significant amounts, in total, to customers at the lower end of the income spectrum, the potential to blow up the balance sheet is always there. We have seen this many times throughout history, and in many ways we saw it in 2022 in the BNPL market in developed markets like the U.S. and UK.

Nubank – Q3 ’22

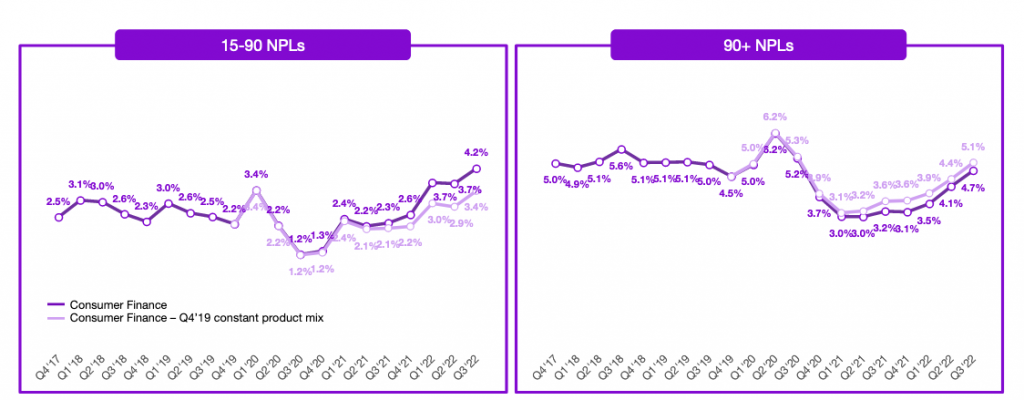

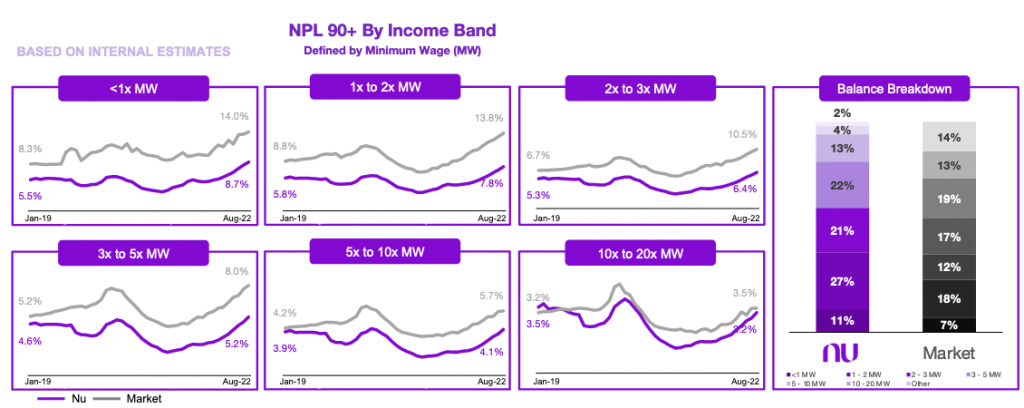

Nubank does lend to a lot of Low-income customers. And their delinquency rates started to shoot up late in 2022.

Nubank – Q3 ’22

‘NPL’ stands for ‘Non-performing Loan.’ We can see that a similar pattern emerged in 2020 during the lockdown period, before reversing. It is intuitive that NPL rates will be higher in lower-income groups, as we can see below.

Nubank – Q3 ’22

Naturally, NuBank has stated they have ‘superior credit underwriting’ and is ‘adequately pricing credit risk.’ Yet if we see a sharp macro downturn or any major events in 2023 that were similar to 2020, this risk may start to the company’s outlook.

Thus 2023 looks full of major swings in both potential directions for Nubank. It’s rapid growth in Mexico and continued dominance in Brazil bode well for it’s top-line growth heading into the year.

Nucoin adds another dimension of potential upside to the company, with little downside. But risks to their credit portfolio ticked-up at the tail end of 2022, and the overall global economic outlook looks rocky heading into 2023.

Nubank — Business Model

The company offers the customers a low interest and a no-fee credit card which can be managed with the help of Android and iOS. Users can track and control their purchases with the help of this platform.

Nubank Website

Nubank Website

Bajaj Finserv Success Story | Instant Loans | EMI | Business Model

Company Profile is an initiative by StartupTalky to publish verified informationon different startups and organizations. The content in this post has beenapproved by the organization it is based on. Finance is a word which everybody has come through and will be going through forperhaps ages also…

StartupTalkyPurbalee Dutta

Бразилия продолжает использовать криптовалюту

До запуска новой услуги пользователи Nubank могли получить доступ к криптовалюте только через биржевые фонды (ETF), предлагаемые инвестиционным подразделением необанка NuInvest.

В феврале многонациональный конгломерат Berkshire Hathaway, возглавляемый известным критиком биткойнов и миллиардером Уорреном Баффетом, купил акции Nubank на сумму 1 миллиард долларов.

Помимо Nubank, другое бразильское финансовое учреждение BTG Pactual объявило о планах по запуску новой платформы, которая позволит клиентам получить доступ к биткойнам и эфиру.

Ранее в мае сообщалось, что сделка по приобретению крупнейшего бразильского криптоброкера 2TM биржевым гигантом Coinbase завершилась.

Избранное изображение предоставлено Exame

InstantPay

Один из лидеров индийского финтеха — InstantPay. К сожалению, информации о нем не очень много. Компания была основана в 2013 году в Нью-Дели как дочерняя компания SMSdaak India Ltd. В конце 2016-го она привлекла инвестиции от сингапурских RB Investments и Kaleden Holdings на сумму от трех до пяти миллионов долларов. Основные банки-партнеры — ICICI Bank, Axis Bank, IndusInd Bank и Yes Bank.

InstantPay предоставляет своим клиентам полный набор банковских услуг. Через компанию проходит до миллиона платежей в день. Средний общий объем трансакций за квартал составляет миллиард долларов. В 2019 году InstantPay начала предоставлять услуги малому и среднему бизнесу

Компания уделяет большое внимание развитию API-банкинга (чаще его называют Open Banking — открытый банкинг). О том, что это такое, поговорим чуть позже

Набор финансовых услуг InstantPay пока не очень широк — например, компания пока не выдает кредиты физическим лицам, а возможности инвестирования ограничены депозитами и цифровым золотом (ценные бумаги, номинированные в золоте). Один из главных продуктов — предоплаченные карты, которые позволяют получить доступ к финансовым услугам тем, у кого нет банковского счета, а также дают возможность пополнить свой банковский счет наличными в сети микроотделений (Digi Kendras.) по всей стране, что-то вроде микроотделений Почта-банка в почтовых отделениях в России. Впрочем, сети таких микроотделений в Индии есть и у других финансовых организаций — это своего рода национальная особенность. InstantPay уделяет довольно много внимания работе с МСП, это отличает ее от ведущих необанков в других странах мира.

Если посмотреть на финансовые показатели, то в 2021-м финансовом году InstantPay планирует получить доход от основной деятельности (выручку) в размере 3,5 млрд рупий (примерно 49 млн долларов), это почти в два раза больше 1,85 млрд рупий, которые компания заработала в 2020-м фискальном году (закончился в марте 2020-го). Но о размерах прибыли или убытков компания не сообщает.

Для большинства клиентов необанков те по-прежнему не являются основным банком. Видимо, не успели пока заработать достаточный уровень доверия. Фото: Zuma\TASS

Для большинства клиентов необанков те по-прежнему не являются основным банком. Видимо, не успели пока заработать достаточный уровень доверия. Фото: Zuma\TASS

Параметр 2. Рост бизнеса

Теперь посмотрим на доходы наших героев, и выясним, какая у них динамика выручки.

Итак, что мы видим?

Обе компании показывают отличный рост выручки, но все же по темпам роста российский банк проигрывает своему бразильскому конкуренту. Ведь «Тинькофф» — это уже зрелый банк с многолетней историей. А вот бразильский стартап бурно захватывает менее конкурентный рынок Бразилии. Разницу мы видим вот в этой таблице (рис. 1).

|

«Тинькофф» |

Nubank |

|

|

Средний темп роста выручки за последние 4 года |

33,46% |

58,28% |

Рис. 1. Сравнение роста выручки.

Однако смотреть нужно не только на финансовые показатели, но и на то, как растёт количество пользователей у сервисов компаний. Этот показатель позволяет понять, насколько сервис, условия и продукты удобны и популярны.

Чтобы проанализировать этот показатель, мы будем использовать данные о количестве активных пользователей. Такими являются клиенты, которые постоянно пользуются хотя бы одним продуктом компании. Также будет полезным взглянуть на популярный показатель MAU — monthly active users, или клиенты, которые пользуются приложением хотя бы раз в месяц. Рассмотрим эти показатели за последние годы.

Как можно заметить, и тут «Тинькофф» проигрывает своему молодому сопернику. Ведь «Тинькофф» борется за клиентов с такими сильными соперниками, как «Сбер», «ВТБ», «Альфа Банк» и другие. Рынок Бразилии в этом плане пока менее насыщен, а значит, и конкуренция там ниже. Смотрим в эту таблицу (рис. 2).

|

«Тинькофф» |

Nubank |

|

|

Среднегодовой темп роста активных пользователей |

39,87% |

105,01% |

|

Среднегодовой темп роста количества ежемесячных пользователей |

50,74% |

90,58% |

Рис. 2. Темпы роста числа пользователей.

И мы видим, что по итогам второго месяца «Тинькофф» разочаровал нас своей медлительностью и уступил конкуренту. Счет становится 1:2 в пользу бразильца.

Немного статистики и истории

По данным портала Paymentscardsandmobile в 2018 году в мире насчитывалось 60 необанков. На начало 2021 года количество цифровых учреждений выросло до 319 активных. Причем только за два последние года (в 2019 и в 2020 году) открылись 144 новых необанка. Причем одинаковое количество – по 72.

Первые необанки начали появляться в Европе в 2015 году. Первопроходцами в новой финтех-сфере стали финансовые компании: Великобритании, Германии, Франции, Финляндии. А уже оттуда новый тренд распространился по всему миру. По данным портала Exton, сегодня в Европе работает около 100 необанков, где зарегистрировано 50 млн. пользователей.

Лидером по количеству цифровых банков на европейском континенте является Великобритания. Благодаря низким налогам, развитой инфраструктуре, государственной поддержке, здесь сформировались прекрасные условия для открытия необанков. Сегодня там работает 37 подобных организаций, треть всех европейских цифровых банков.

Внимание! В ТОП-5 стран с активными рынками необанков входят: Великобритания, Южная Корея, Швеция, Франция и Бразилия (Exton Neobanking Database). Быстрый рост популярности необанков зафиксирован в Латинской Америке

Сегодня там насчитывается около 50 необанков. Причем 12 новых финансовых организаций запустили в 2020 году. Стремительно необанки начали развиваться в Китае. Местные цифровые банки (Ant Financial и WeBank) одни из самых крупных в мире

Быстрый рост популярности необанков зафиксирован в Латинской Америке. Сегодня там насчитывается около 50 необанков. Причем 12 новых финансовых организаций запустили в 2020 году. Стремительно необанки начали развиваться в Китае. Местные цифровые банки (Ant Financial и WeBank) одни из самых крупных в мире.

О перспективах дистанционных банковских услуг свидетельствует огромный интерес к отрасли среди инвесторов. Даже за «карантинный» 2020 год необанки привлекли более $2 млрд. венчурного капитала по всему миру. По прогнозам аналитиков PitchBook до 2024 года количество пользователей приложений необанков в Северной Америке и Европе достигнет 145 млн.

Драйверы роста

В большей мере необанк сегодня зарабатывает на следующих аспектах собственной деятельности:

- комиссиях, получаемых от кредитных карт, которые его клиенты используют при расчете в магазинах и т.д.;

- услуг брокеров и управляющих компаний, предлагающих клиентам выход на межбанк.

Учитывая, что адресный рынок предприятия сегодня оценивается в 650 млн клиентов, учитывая, что на данный момент их уже 47 млн, компании действительно есть куда расти и развиваться в будущем. То есть, увеличить количество потребителей в 13 раз, ему не составит никакого труда. Несомненно, данное развитие событий возможно исключительно при благоприятно сложившейся ситуации. Однако из внимания все же не стоит упускать и другие банки, являющиеся прямыми конкурентами Nubank. Они тоже имеют возможность запустить привлекательные с точки зрения клиентов услуги и программы, снизив комиссии.

С декабря 2001 года активы Nubank обращаются на американской фондовой бирже. С их помощью компании удалось привлечь в собственный бюджет около 2,6 млрд долларов. Само же предприятие было оценено на тот момент в 41,5 млрд долларов. Сегодня Nubank является второй по капитализации компанией в Латинской Америке, на первом месте находится Itau Unibanco Holding SA, оцененная в 55 млрд долларов.

Business Model of Neobank app like Nubank

Neobank app like Nubank’s business model is based on providing accessible and convenient financial services to its customers through a digital platform. The company generates revenue primarily through its credit card operations, which are designed to be more affordable and transparent than traditional banks.

Some key aspects of Nubank’s business model include:

-

Digital-only approach: Nubank app operates entirely through its mobile app and website, without any physical branches. This helps the company keep costs low and offer competitive rates to its customers.

-

Credit card operations: Nubank’s flagship product is its credit card, which is designed to be fee-free and easy to use. The company generates revenue through transaction fees and interest on outstanding balances.

-

Personal loan products: In addition to credit cards, Nubank app also offers personal loans to its customers. These loans are also fee-free and have a simple application process, with interest rates based on creditworthiness.

-

Savings accounts and investment products: Nubank app also offers savings accounts and investment products, which allow customers to earn interest on their deposits and invest in a range of products.

-

Focus on customer experience: Nubank app places a strong emphasis on customer service and satisfaction, with features like real-time notifications, 24/7 customer support, and a user-friendly app interface.

Nubank’s business model is built on providing simple, affordable, and accessible financial products to its customers, while keeping costs low through a digital-only approach.

Параметр 7. Последние события в компании

Итак, друзья, у нас последний этап сравнения. Давайте сравним последние новости о компаниях и подведём итоги нашего состязания.

«Тинькофф Банк» расширяет международную экспансию и планирует получить лицензию для работы на Филиппинах. Также у компании недавно стало два исполнительных директора: Оливер Хьюз и Павел Федоров. Такое решение должно помочь компании выйти на международные рынки. А ещё развивается спектр банковских услуг: недавно был приобретен сервис для работы с самозанятыми Jump.Finance.

Как видим, «Тинькофф» не стоит на месте и развивает свой бизнес теперь уже на международной арене. По Nubank новости более скромные, и нельзя даже сказать, насколько они положительны для бизнеса.

Итак, ещё +1 балл в копилку «Тинькофф». А Nubank ничего не получает.

Ну что, подведем итоги. И мы видим, что «Тинькофф» заработал 6 баллов. А у Nubanka всего 2. «Тинькофф» обошел конкурента втрое, и это наш безоговорочный победитель! Опыт и многолетнее развитие позволили ему раскрыть свои сильные стороны. Но, возможно, и Nubank улучшит свои показатели в скором будущем. Будем ждать и следить.

Результаты нашего баттла можно посмотреть в этой табличке. (рис. 6).

|

«Тинькофф» |

Nubank |

|

|

Параметр 1 (положение на рынке) |

+1 |

+1 |

|

Параметр 2 (рост бизнеса) |

+1 |

|

|

Параметр 3 (рентабельность) |

+1 |

|

|

Параметр 4 (долговая нагрузка) |

+1 |

|

|

Параметр 5 (оценка по мультипликаторам) |

+1 |

|

|

Параметр 6 (возврат средств акционерам) |

+1 |

|

|

Параметр 7 (последние события в компании) |

+1 |

|

|

Итоговый счет |

6 баллов |

2 балла |

Рис. 6. Результаты.

ORIGINS of NUBANK

It was in the restrictive banking climate of Brazil that Nubank emerged back in 2013 (founded by David Vélez, Cristina Junqueira, and Edward Wible), as a startup focused on giving individuals financial control of their lives. David (CEO) had prior venture experience with Sequoia Capital, in leading their investments in Latin America. Cristina previously worked in Sao Paulo for both banking and consulting firms. Edward (CTO) has a background in private equity investments and consulting. Less than a year after being founded (in April 2014), Nubank would post its first Nubank card transaction. This purple card would go on to be used by over 20M customers in Brazil.

The company is backed by well-known investors such as Goldman Sachs, Ribbit Capital, Tencent, and Fortress Investment Group. Nubank’s funding history:

-

Series A round of $14M from Sequoia in 2013;

-

$30M Series B in 2014 from Tiger Global Management;

-

$52M Series C in Jan. 2016 from Founders Fund;

-

$80M Series D in Dec. 2016 from DST Global;

-

$150M Series E in 2018 (also from DST);

-

$400M Series F in 2019 from TCV.

With about $1.4B in total funding, the world’s largest neobank is now valued over $10B. This consistent level of funding has helped Nubank achieve remarkable growth in its transaction activity, product suite, and overall reach in Latin America. The combination has helped the fintech double its customer size between 2018 and 2020, now serving more than 22M clients in Brazil alone.

Заключение

Необанкинг — это новое явление, которое недавно появилось на рынке FinTech и уже вызвало большой интерес. Многие компании и частные пользователи находят использование услуг необанков более привлекательным, чем посещение стационарных банковских учреждений, благодаря скорости обслуживания и значительно более низким тарифам.

В связи с растущей популярностью и перспективами финтех-направления, многие компании стали вкладывать средства в развитие своих собственных необанковских продуктов. Компания СКЭНД может помочь Вам в разработке ПО для финтеха любой сложности. Напишите нам и мы поможем.