Дотянуться до звёзд [litres]: краткое содержание, описание и аннотация

Он поклялся никогда не влюбляться. Она подарила ему шанс дотянуться до звезд… Я влюбилась в Коннора. В его стихи, в его слова, которые проникают мне в самое сердце, в его прекрасную душу. Он понимает меня так, словно читает мысли. И я не могу, да и не хочу бороться со своими чувствами. Но если я люблю Коннора, тогда почему меня как магнитом тянет к Уэстону? Высокомерному, угрюмому, острому на язык Уэстону, чей ледяной взгляд обжигает. Ни один из нас не может отрицать тех искр, что вспыхнули между нами. Когда волею случая Коннор и Уэстон отправляются в армию, в горячую точку, я понимаю, что мое сердце они забрали с собой. Я мечтаю, чтобы у них был шанс вернуться из этого ада невредимыми. Но что, если любовь может спасти лишь одного из них? Смогу ли я сделать такой выбор?

Is Zoom still a good Buy?

Zoom is a video conferencing company that went public in April 2019. The company is valued at $9.2 billion and has seen its stock price surge since its IPO. However, some investors are now questioning whether Zoom is still a good buy.

Zoom is a high-growth company and is expected to see its revenue grow by more than 50% in 2019. The company has a strong competitive advantage in the video conferencing market and is well-positioned to take advantage of the growing demand for video conferencing.

However, Zoom faces some risks. The company is dependent on the success of its products, and any slowdown in demand could hurt its growth. Additionally, Zoom is not profitable and is expected to incur losses in the near future.

Overall, Zoom is a high-growth company with a strong competitive advantage. The company is still a good buy for investors, but investors should be aware of the risks associated with investing in Zoom.

Why is Pelotons stock dropping?

Peloton, the high-end fitness equipment company, has been having a rough go of it lately. Their stock price has been dropping steadily for the past few months, and it’s unclear why.

There are a few potential reasons for Peloton’s stock price dropping. The company may be struggling to keep up with growing competition from other fitness companies, such as SoulCycle and Flywheel. Peloton may also be experiencing financial difficulties, as they’ve been increasing their spending on marketing and product development.

Whatever the reason, Peloton’s stock price is sure to rebound eventually. The company is still doing well, and they have a loyal fanbase that is passionate about their products. Peloton is a well-respected brand, and I’m sure they will continue to be a major player in the fitness industry.

What is Peloton Row?

- 23.8-inch HD rotating screen

- Form Assist and Form Rating features

- All-Access Membership required

The Peloton Row is the company’s first rowing machine and it follows a similar design to the Bike, Bike+ and Tread offerings. There’s a 23.8-inch swiveling touchscreen like the Bike+ and it offers front and rear-facing speakers so you can hear the instructor and music loud and clear.

The Peloton Row has a footprint of 2440mm (8-foot) by 610mm (2-foot) so it’s relatively compact and it also has a folding arm for compact and upright storage.

Like other Peloton products, it requires a Peloton All-Access Membership which will deliver access to thousands of classes. The Peloton Row also has features like Form Assist to highlight ways to improve your form and Form Rating and Insights to track your progress and view your performance.

Обретет ли edtech возможность или устранит потребность в высшем образовании?

Изображение Кредиты: Брайс Дурбин

Не имея опыта работы в кампусе, многие студенты (и их родители) задаются вопросом, насколько ценно посещение занятий через ноутбук в общежитии.

Хуже того: сокращение набора вынуждает многие учебные заведения отказываться от специальностей и искать другие способы сокращения расходов, такие как увольнение персонала и сокращение спортивных программ.

Решения Edtech могут восполнить этот пробел, но в высшем образовании нет реального консенсуса по поводу того, какие инструменты работают лучше всего. Многие колледжи и университеты используют ряд «сторонних решений, чтобы поддерживать работу на плаву», — сообщает Наташа Маскареньяс.

«Это стресс-тест, который может привести к расплате среди стартапов в сфере образовательных технологий».

Генеральный директор Autodesk Эндрю Анагност объясняет стратегию приобретения Spacemaker

Эндрю Анагност, президент и генеральный директор Autodesk.

Ранее на этой неделе Autodesk объявила о покупке Spacemaker, норвежской фирмы, которая разрабатывает программное обеспечение с поддержкой искусственного интеллекта для городского развития.

Репортер TechCrunch Стив О’Хир взял интервью у генерального директора Autodesk Эндрю Анагноста, чтобы узнать больше о приобретении, и спросил, почему Autodesk заплатила 240 миллионов долларов за команду Spacemaker из 115 человек и интеллектуальную собственность, особенно когда рядом с ее штаб-квартирой в Bay Area были другие стартапы.

«Они создали реальное, практичное и удобное приложение, которое помогает определенной части нашего населения использовать машинное обучение, чтобы действительно добиться лучших результатов в критически важной области, а именно в перестройке и развитии городов», — сказал Анагност. «Так что это полностью соответствует тому, что мы пытаемся сделать»

«Так что это полностью соответствует тому, что мы пытаемся сделать».

What is the Peloton Digital app and what does it offer?

- $12.99/£12.99 a month

- Over 10 workout types

- Doesn’t require Peloton products

Peloton Digital is an app for mobile devices and some streaming media devices. It works with Apple TV, Fire TV, Roku, Android TV, Chromecast and Apple Airplay.

It doesn’t require Peloton products and you can try it out for a month before you have to pay a monthly subscription. After the 30-day trial period, the Peloton Digital app costs $12.99/month in the US or £12.99/month in the UK. If you have the Peloton Bike, Bike+, Tread or Row, the Peloton Digital app is included within the Peloton All-Access Membership, which is required for the Peloton products.

The Peloton Digital app has over 10 workout types, including strength, stretching, bootcamp, cycling, outdoor running, yoga and meditation. You can work out alongside others, track your progress with metrics and you can challenge yourself and earn achievements. There’s also Peloton Gym, which allows you to do curated strength programmes from anywhere.

The Peloton Digital app is available to download on the Apple App Store, Google Play Store, Amazon App Store and Roku.

Will zoom stock go up again?

Zoom stock has been on the rise lately, with many investors predicting that it will continue to go up. However, it’s important to remember that stock prices can go up or down for a variety of reasons, and it’s never possible to say for certain what will happen in the future.

That said, there are a few reasons why Zoom stock may continue to go up. The first is that the company is doing well and is growing rapidly. In its most recent quarter, Zoom reported a 116% increase in sales year-over-year. The company is also profitable, and its margins continue to grow.

Another reason for the stock’s rise may be investor confidence in the company’s management. The CEO and CFO have both been with Zoom for a long time, and they have a good track record of creating value for shareholders.

Finally, there’s the potential for a takeover. Zoom is a relatively small company, and it’s possible that a larger player could see it as a valuable acquisition target.

All of these factors together could explain why Zoom’s stock price has been on the rise, and there’s a good chance that it will continue to go up in the future. However, investors should always do their own research before making any decisions.

Перспективы Peloton кажутся мрачными

Будучи розничным продавцом дорогостоящих дискреционных товаров, Peloton может увидеть, как соль втирают в ее раны, если повышение ставок Федеральной резервной системы США приведет к более жесткому, чем ожидалось, приземлению.

В трудные времена просто нет большого спроса на дорогие велотренажеры. Кроме того, разрушение спроса, вызванное рецессией, может повредить способности Peloton преодолевать инфляционное давление.

Peloton создала для себя бренд, но его уровень не дает мне уверенности в способности фирмы переложить более высокие расходы на своих потребителей.

Во всяком случае, Peloton, возможно, придется ввести дополнительные скидки на свою продукцию перед лицом более высоких цен.

Это не сулит ничего хорошего для маржи, но ключом к долгосрочному росту может быть абонентская база фирмы. В каком-то смысле Peloton может быть скорее технологической компанией, чем розничным продавцом товаров длительного пользования.

Падение Peloton Stock продолжается

Акции Peloton в настоящее время упали в общей сложности на 88% по сравнению с историческим максимумом чуть севернее 160 долларов за акцию. Такой высокий уровень вряд ли повторится в следующем десятилетии. Несмотря на это, у производителя стационарных велосипедов стоимостью 6,8 миллиарда долларов есть некоторые рычаги роста, которые он может использовать, чтобы затормозить массивное падение акций.

Учитывая массовое увольнение 2800 сотрудников, кажется, что компания сбилась с пути. После такого шока фирме в ближайшем будущем будет сложно привлекать таланты.

Что отличает Peloton от большинства других производителей оборудования, так это его способность к инновациям. Из-за уценки продукции и увольнений инициативы по сокращению затрат могут оказаться слишком глубокими.

Исследования и разработки, вероятно, являются единственным джокером, который может помочь Peloton снова подняться выше 50 долларов. Тем не менее, я бы не исключал возможности участия покупателя в этих Оценка акцийх.

Бренд Peloton обладает большой нематериальной ценностью и его многочисленными подписчиками, которые могут оказаться липкими в долгосрочной перспективе. Такое дополнение обязательно укрепит поток доходов от услуг любой компании.

На данный момент движение акций Peloton по умолчанию выглядит более низким, что по-прежнему будет проблемой для покупателей, которые прыгают без учета катализатора. Поскольку компания ищет другие возможности для роста, она также рискует засунуть руку в слишком много пирогов.

Несмотря на это, Оценка акций была так резко сброшена, и акции уже стали примером. Хотя путь Peloton вперед может быть менее ясен, планка была установлена так низко, что я не думаю, что потребуется много времени, чтобы акции выросли на результат лучше, чем опасались.

При продажах в 1,5 раза трудно быть медвежьим по отношению к бывшему технологическому любимцу, который может приближаться к территории с высокой стоимостью.

Is Zoom a good long term buy?

Zoom is an online video conferencing company that was founded in 2011. The company has seen impressive growth in recent years and is now a publicly traded company. So, is Zoom a good long term investment?

Zoom is a good long term investment for a few reasons. First, the company is seeing impressive growth. In the past year, Zoom’s revenue has grown by 81%. The company’s customer base is also growing rapidly, with over 50,000 customers as of Q1 2019. Additionally, Zoom is profitable and has a positive cash flow.

Second, Zoom has a strong competitive advantage. The company’s products are well-received by customers and it has a large market share in the online video conferencing market. Zoom’s products are also highly differentiated, which gives the company a competitive edge.

Third, Zoom is a well-run company. The company has a strong management team and is focused on creating value for shareholders. Zoom has a good track record of execution and is well-positioned for continued growth.

Overall, Zoom is a good long term investment. The company is seeing strong growth, has a strong competitive advantage, and is a well-run company. If you’re interested in investing in Zoom, the stock is currently trading at around $80 per share.

What’s the difference between the Peloton Bike and Bike+?

- Bike+ has bigger rotating screen

- Bike+ has more speakers

- Bike+ has automatic resistance changing

As we’ve mentioned, Peloton has two exercise bikes in its range: the Peloton Bike and the Bike+. Both bikes have the same 1200 x 600mm footprint, both come with Peloton app access and both have individual profiles for household access (up to six profiles can be added). They also both have delivery and assembly included in their prices and they both have access to thousands of Peloton classes.

The two bikes also have adjustable seats, handlebars and screens and they both have the same user requirements. The main difference is the original Peloton Bike has a height adjustable 21.5-inch HD touchscreen, while the Bike+ has a rotating 23.8-inch HD touchscreen with 360-degrees of movement. The rotating screen means you can turn the display for when you are doing strength workouts or yoga or pilates for example, rather than bike workouts.

The Bike+ also comes with four-channel audio with two 3-watt tweeters and two 10-watt woofers, while the Bike offers just two 10-watt speakers. Additionally, the Bike+ has Apple GymKit integration — which is excellent in our experience — and a Resistance Knob with Auto Follow, which means the bike automatically adjusts the resistance to the instructors recommendation, while the original Bike requires you to do this manually.

In terms of specs, the Bike+ has a slightly faster processor than the Bike, double the RAM and a slightly higher resolution front camera. It also has Bluetooth 5.0 instead of Bluetooth 4.0 and it has a USB-C port for charging devices rather than a USB microport.

Firm’s largest sales of the 1st quarter

Tiziano Frateschi

May 28, 2021

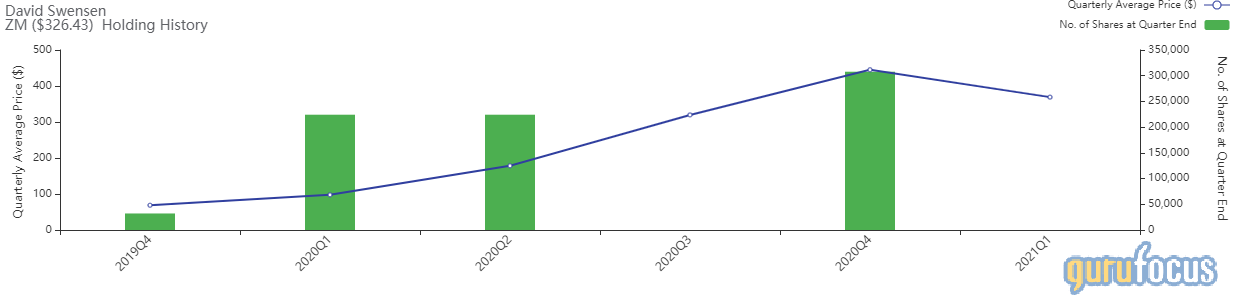

Daivd Swensen’s Yale University sold shares of the following stocks during the first quarter of 2021, which ended on March 31.

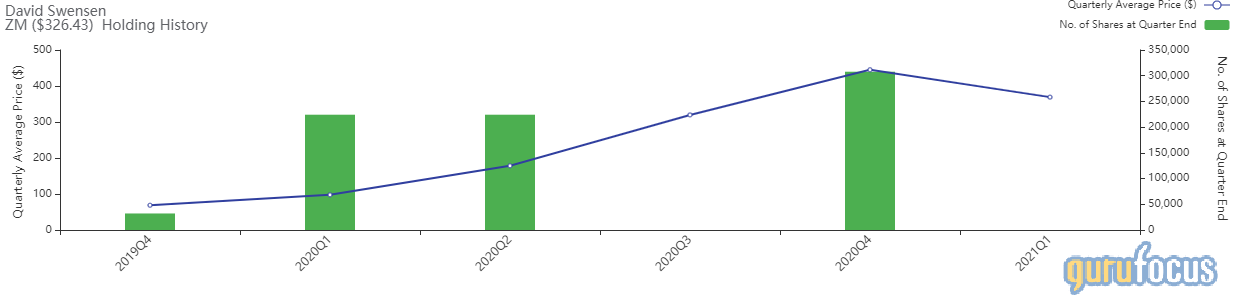

Zoom Video Communications

The guru closed the position in Zoom Video Communications Inc. (ZM), impacting the portfolio by 70.47%.

The company, which provides a communications platform, has a market cap of $96.12 billion and an enterprise value of $91.98 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of 40.48% return on assets of 23.46% are outperforming 93% of companies in the telecommunication services industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 40.04.

The largest guru shareholder of the company is Baillie Gifford (Trades, Portfolio) with 2.76% of outstanding shares, followed by Catherine Wood (Trades, Portfolio) with 1.02% and Jim Simons (Trades, Portfolio)’ Renaissance Technologies with 0.86%.

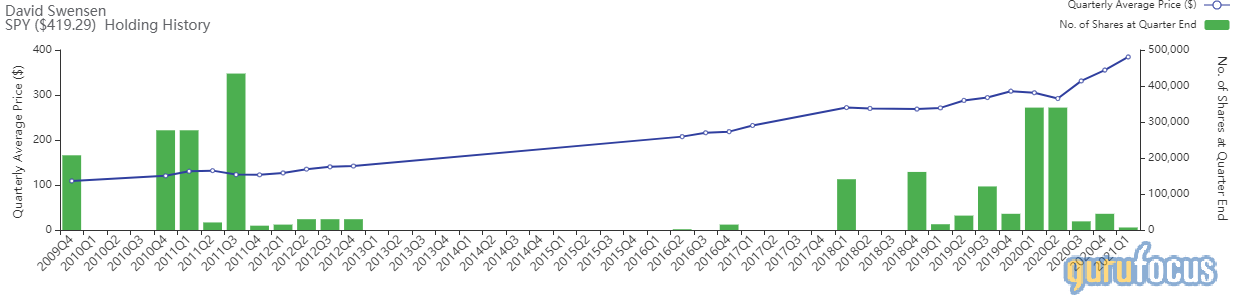

S&P 500 ETF TRUST ETF

The guru’s S&P 500 ETF TRUST ETF (SPY) position was reduced by 84.44%, impacting the portfolio by -9.64%.

Peloton Interactive

The guru’s Peloton Interactive Inc. (PTON) position was closed, impacting the portfolio by -5.18%.

The company operates an interactive fitness platform has a market cap of $33.59 billion and an enterprise value of $32.36 billion.

The return on equity of 11.96% return on assets of 6.04% are outperforming 86% of companies in the travel and leisure industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 1.84.

The largest guru shareholder of the company is Gifford with 5.48% of outstanding shares, followed by Chase Coleman (Trades, Portfolio) with 2.63% and Spiros Segalas (Trades, Portfolio) with 1.09%.

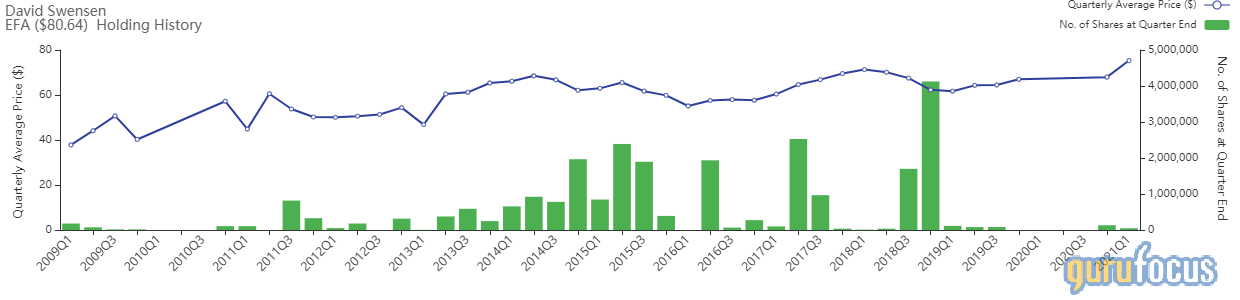

iShares MSCI EAFE ETF

The firm trimmed its position in the iShares MSCI EAFE ETF (EFA) by 62.6%. The trade had an impact of -4.06% on the portfolio.

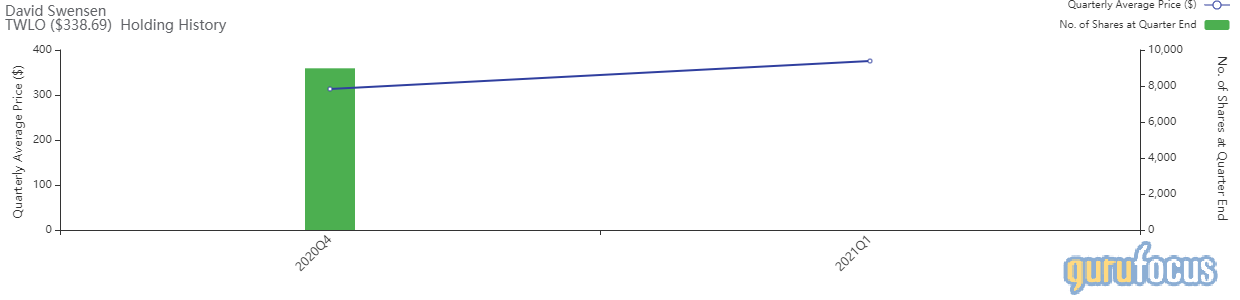

Twilio

The firm exited its position in Twilio Inc. (TWLO). The trade had an impact of -2.06% on the portfolio.

The communications-platform-as-a-service company has a market cap of $58.49 billion and an enterprise value of $54.29 billion.

GuruFocus gives the company a profitability and growth rating of 2 out of 10. The return on equity of -9.12% and return on assets of -7.75% are underperforming 67% of companies in the interactive media industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 3.78.

The largest guru shareholders of the company include Gifford with 2.77% of outstanding shares, Frank Sands (Trades, Portfolio) with 2.62% and Wood with 1.58%.

Inozyme Pharma

The guru closed the position in Inozyme Pharma Inc. (INZY), impacting the portfolio by -1.59%.

The rare disease biopharmaceutical company has a market cap of $401.80 million and an enterprise value of $260.58 million.

GuruFocus gives the company a profitability and growth rating of 1 out of 10. The return on equity of -45.84% and return on assets of -2,647.42% are underperforming 81% of companies in the biotechnology industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 37.53 is above the industry median of 13.32.

Disclosure: I do not own any stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

Что-нибудь, чтобы с нетерпением ждать?

В долгосрочной перспективе Peloton сможет вводить новшества, чтобы отличаться от новых участников интерактивного фитнес-пространства.

Тем не менее, Lululemon (LULU) и другие игроки, такие как Tonal, могут пойти дальше Peloton, продвигая свои собственные предложения.

Peloton может расшириться, занимаясь силовыми тренировками, йогой или боксом в поисках роста за пределами своего текущего состава. Тем не менее, среда становится конкурентной, так что любые подобные боковые движения, скорее всего, приведут лишь к снижению рентабельности роста продаж.

До тех пор, пока Peloton не станет больше цениться за счет своей пользовательской базы, а не за счет продаж оборудования, Уолл-стрит вряд ли оценит такой рост. Не с темпами растут так быстро, как они.

What can the Peloton Bike and Bike+ do?

- 21.5 or 23.8-inch HD touchscreen

- Live and on-demand workouts

- All-Access Membership required

Peloton’s indoor exercise bikes are a stationary piece of at-home gym equipment with a large touchscreen attached. There are thousands of video sessions available through the Peloton All-Access Membership — more on that below — including short workouts for people with more limited schedules.

There are multiple fitness instructors to choose from for classes, recorded classes and music. It’s packed with plenty of other social features too, like the ability to virtually ride with friends, high five other members, as well as leaderboards with achievement badges.

The bikes require cleats, which are sold separately. And their handlebars only move up and down, not fore and aft — though the saddle moves forward and back. The screen on the original Bike is fixed in front of the handlebars, and it can’t be used for other purposes, such as watching YouTube videos or Netflix. The screen on the Bike+ rotates, but it is still only for the Peloton interface and not third party apps. For everything the Peloton Bike and Bike+ can do, we have a Bike tips and tricks feature.

Related

Peloton Bike review: King of the rollers

If you’re interested in spinning at home, the Peloton Bike is the top-of-the-line bike to buy. It’s like the iPhone of spin bikes.

Related

Peloton Bike+ review: Pedal power!

Is the top-tier Peloton spin bike worth its outlay and ongoing monthly subscription? You might think not, but here’s why you might change your mind…

What’s the difference between the Peloton Tread and Tread+?

There are a few differences between the Peloton Tread and the Tread+. The Tread is the cheaper of the two options, and available in the UK and US, while the Tread+ was only available in the US, though as we’ve said, it is no longer available following some safety concerns.

Both have the same processor, RAM and internal storage and they both offer the same features, including access to the live classes and on-demand classes, in-workout metrics, individual profiles for household access, training programs and challenges and workout history.

The Tread is newer than the Tread+, has a USB-C port for charging devices, Bluetooth 5.0, an 8-megapixel front facing camera, built-in four digital microphone array and front facing stereo speakers with rear-facing woofers. It has a smaller screen compared to the Tread+ and it doesn’t have a Free Mode for pushing the slat belt on its own. As mentioned above, it also has a different belt to the Tread+ and it’s slightly smaller.

The Tread+ had a larger screen, Free Mode and a larger running space, as well as a shock-absorbing belt, but it offered a standard USB port for charging devices, Bluetooth 4.0 and a 5-megapixel front-facing camera. It also had a soundbar instead of front and rear speakers.

Other differences between the Tread and Tread+ are the Tread has a 3 HP DC motor and a screen adjustment between 0 and 50-degrees, while the Tread+ had a 2 HP DC motor and screen adjustment between 0 and 30-degrees. The Tread also has incline of 0 to 12.5 per cent, while the Tread+ offered 0 to 15 per cent.

The Tread is smaller and lighter, measuring 1727 x 838 x 1575mm and weighing 131.5kg. It has a step up height of 203mm. The Tread+ meanwhile, measured 1842 x 927 x 1829mm and weighed 206kg. It had a step up height of 292mm.

Peloton

3 тактики роста, которые помогли нам превзойти Noom и Weight Watchers

3D-рендеринг динамитных палочек TNT в картонной коробке на синем фоне. Взрывоопасные материалы. Опасный груз. Сюжет теракта. Изображение Кредиты: Gearstd/Getty Images.

Я ищу написанные гостями статьи Extra Crunch, которые помогут другим предпринимателям добиться большего успеха, поэтому я обычно отклоняю заявки, которые кажутся чрезмерно рекламными.

Однако Хенрик Торстенссон (генеральный директор и соучредитель Lifesum) опубликовал сообщение о методах, которые он использовал для масштабирования своего приложения по питанию за последние три года. «Это стратегия, которую может использовать любой стартап, независимо от размера и бюджета», — пишет он.

По данным Sensor Tower, Lifesum растет почти в два раза быстрее, чем Noon и Weight Watchers, так что ставить его компанию в центр истории имело смысл.

What can the Peloton Tread and Tread+ do?

- 23.8-inch or 32-inch HD screen

- 0-20mph speed

- All-Access Membership required

The Peloton Tread features a traditional running belt with 1500mm of running space, while the Peloton Tread+ has a shock-absorbing slat belt and a running space of 1700mm, though as we mentioned, the Tread+ has been discontinued.

The Tread has a 23.8-inch HD touchscreen, like the Bike+, while the Tread+ had a larger 32-inch HD touchscreen, and delivery and assembly are both included in the price. The Peloton Tread offers speeds between 0 and 20mph, with 0.1mph increments, which the Tread+ also offered.

There are adjustable knob controls, a jump button to increase the speed and incline by 1mph and 1 per cent, individual profiles for household access and Peloton app access, like the Bike and Bike+. You’ll also find speakers, port for charging devices, a front-facing camera, 3.5mm headphone jack and Bluetooth.

The classes — which are part of the All Access membership — include speed, fun runs, HIIT and bootcamp, among others. There are live and on-demand classes, and there is a variety of locations and scenery to choose from to keep things different. There’s also a live Leaderboard to keep you motivated, along with metrics including distance, speed, elevation and calories.

For everything the Peloton Tread can do, we have a Tread tips and tricks feature.

Related

Peloton Tread review: An excellent running machine

The Peloton Tread is the second — and slightly smaller — treadmill to come from the company. It’s got a big price tag though so is it worth the money?

Related

Создатели телесериала

В ролях

- Эдуардо Капетильо — Эдуардо Касабланка «Рамон Санчес»

- Мариана Гарса — Лорена Гайтан Роса «Мелисса»

- Энрике Лисальде — Мариано Касабланка

- Ана Сильвия Гарса — Норма Роса вдова де Гайтан’

- Кения Гаскон — Гуадалупе «Лупита» Патиньо «Дебора Лавалье»

- Оскар Травен — Роке Эскамилья

- Анхелика Ривальсаба — Аурора Руеда

- Маркос Вальдес — Амадеус Сильва

- Андреа Легаррета — Адриана Мастрета дель Кастильо

- Эктор Суарес Гомис — Педро Луго

- Алехандро Ибарра — Фелипе Руеда

- Рита Маседо — Вирхиния

- Даниэль Мартин — Хоакин де ла Фуенте

- Серхио Клайнер — Фернандо Мастрета

- Маргарита Исабель — Рита дель Кастильо

- Луис Баярдо — Густаво Руеда

- Дасия Гонсалес — Мария да ла Лус «Луча» де Руеда

- Кита Хунгенс — Сесилия Луго «Сита»

- Дарио Пье — Марио Касабланка

- Лорена Рохас — Сара дель Рио

- Маура Рохас — Лилиана

- Марсела Паес — Ирене де ла Фуенте

- Алисия Монтойя — Хулия Мастрета

- Адриан Рамос — Мануэль Луго

- Рикардо Далмакки — Далмасси

- Маноло Гарсия — Эстебан

- Франсес Ондивьела — Лола

- Октавио Галиндо — Октавио Парра

- Леонорильда Очоа — Соледад «Мать Чоле» Патиньо

- Глория Исагирре — Мария дель Пилар «Пилита» Патиньо

- Эрнесто Яньес — Мартин Негрете Колорадо

- Алехандро Монтойя — Норберто

- Хорхе Паис — Энрике де ла Рива

- Майя Рамос — Фелисия де ла Рива

- Дебора Рейсенвебер — Тания де ла Рива

- Перла де ла Роса — Элиса

- Елена Сильвия — Исабель

- Белен Бальмори — Ванесса

- Алехандра Израэль — Офелия

- Карлос Гарсия — Эдгар Наварро

- Лус Грасия Ласкурайн — София

- Рикардо Архона — камео

- Ботелита де Херес — музыкант группа «Эль Пилон»

- Фернанда Арау — Бернардо «Баррабас»

- Серхио Очоа — Алонсо

- Сесилия Тоисайнт — адвокат Куэвас

- Давид Остроски — адвокат дель Валье

- Анна Чоккети — Шарон

- Лилиан Давис — Росита

- Фелио Элиэль — Дон Севериано

- Херман Новоа — Карлос Руеда

- Мария Прадо — Донья Тере

- Гильермо Сарур — судья

- Бегония Паласиос — Мать Ирене

- Тиаре Сканда — камео, участница песенного фестиваля

- Эктор Ябер — камео, участник песенного фестиваля

- Марта Ягуайо — камео, ведущая песенного фестиваля

- Ванда Сеух — Лукресия Маганья/Лаула Сорайя

- Луис де Льяно Маседо — Луис Эстрада

- Луис де Льяно Пальмер — музыкальный продюсер

- Гарибальди — приглашённые гости

- Маурисио Гарсия

- Алехандро Лорето

- Габриэль Веласкес

Административная группа

- автор сценария: Хесус Кальсада

- литературный редактор: Долорес Ортега

- музыкальная тема заставки: «Alcanzar Una Estrella» + 3 песни

- вокал: Мариана Гарса, Эдуардо Капетильо

- композитор: Херардо Гарсия

- оператор-постановщик: Марко Флавио Крус

- режиссёр-постановщик: Маноло Гарсия

- координатор производства: Хуитлалцин Васкес

- заместитель начальника производства: Росаура Мартинес Феликс

- начальники производства: Адриана Арройо, Хуан Карлос Лопес

- продюсер: Луис де Льяно Маседо

What is the future of Peloton?

The Peloton brand has been around since 2012, initially as a startup focused on developing an at-home fitness bike. The company has seen significant success in recent years, with its Peloton Tread product – a treadmill that can be controlled through a companion app – becoming a best seller.

What is the future of Peloton?

There’s no doubt that Peloton has carved out a significant niche in the fitness industry, and there are several factors that could see the brand continue to grow in the coming years.

Firstly, Peloton’s products are extremely well-priced compared to those of conventional gyms. The Peloton Tread, for example, retails for $4,000 – a fraction of the cost of even a basic treadmill from a traditional fitness equipment supplier.

Secondly, Peloton has a very strong social media presence. The company’s official Instagram account has over 1.3 million followers, and its YouTube channel has amassed over 215 million views. This gives Peloton a powerful platform to reach out to potential customers.

Finally, Peloton is constantly innovating. The company has recently launched a new product – the Peloton Bike – which allows users to participate in live cycling classes from the comfort of their own home. Peloton is also working on a new product that will allow users to stream live yoga classes.

All of these factors suggest that Peloton is here to stay, and that its growth is likely to continue in the years to come.

What is Peloton and what products does it offer?

- Bike, Bike+, Tread, Tread+, Row equipment

- Peloton Guide

- All-Access Membership

- Peloton Digital app

- Peloton accessories

Peloton makes at-home gym equipment, has an exercise app, and produces workout videos that customers can live-stream through Peloton products.

There are two exercise bikes available — Bike and Bike+ — and there were also two treadmill options — Peloton Tread and Peloton Tread+ — though the latter has been discontinued following some safety issues. There is also the Peloton Guide, which is a TV-connected camera that focuses on strength workouts and there is the Peloton Row too, though this is currently US only and not available in the UK or other regions.

Peloton also offers bike accessories, which include Peloton shoes, weights, headphones, a heart rate monitor and a bike mat. There are also resistance bands and Peloton apparel if you’re really keen. We have a couple of bits of apparel (yes we know, we are those people) and it’s actually remarkably comfortable.

Alongside the at-home gym equipment and accessories, Peloton also offers a mobile app that you can sign up for even if you don’t have the Peloton gym equipment. You can read more about the app a little further down.

What is the prediction for Zoom stock?

What is the prediction for Zoom stock?

Zoom is a video conferencing company that went public in April 2019. The company is growing rapidly and is currently valued at $9.4 billion. Some analysts believe that the stock is overvalued and predict that the stock will drop in the future. Other analysts believe that Zoom is a strong company with a bright future and predict that the stock will continue to rise.

Investors should do their own research before deciding whether or not to invest in Zoom stock. The company appears to be growing rapidly and has a lot of potential, but it is also possible that the stock will drop in the future.

Why is zooms stock falling?

The stock prices of Zoom Video Communications, Inc. (ZOOM) have been on a steady decline since the company’s initial public offering (IPO) on April 18, 2019. The company’s stock prices reached an all-time high of $87.50 on the first day of trading, but have since plummeted to a low of $50.85 on July 2, 2019, representing a 41% decrease in value.

There are several potential reasons for Zoom’s stock price decline. One major issue facing the company is its high valuation relative to its peers. At its peak, Zoom’s stock was trading at over 100x its 2019 estimated earnings, compared to a median of 24x for its peers. This high valuation may have been too optimistic, and investors may have begun to doubt Zoom’s ability to maintain its high growth rate.

Another issue facing Zoom is competition from bigger players in the video conferencing market. Cisco Systems, Inc. (CSCO) and Microsoft Corporation (MSFT) both offer video conferencing services that compete with Zoom, and these companies have significantly larger market shares. As these larger players begin to compete more aggressively with Zoom, its market share may begin to decline.

Finally, the market turmoil of the past few months may have also contributed to Zoom’s stock price decline. The S&P 500 has fallen by over 10% since Zoom’s IPO, and investors may be selling off high-growth stocks like Zoom in order to reduce their risk.

Despite these risks, there are several reasons to be bullish on Zoom’s long-term prospects. The company is experiencing strong growth, with revenue and bookings growing by over 100% year-over-year in the first quarter of 2019. Zoom is also profitable, with an EBITDA margin of over 50%.

Additionally, Zoom is still in the early stages of its growth curve. The company’s market share is still small, and it has significant room to expand its customer base. Zoom’s CEO, Eric Yuan, is a proven entrepreneur, and he is committed to building a long-term company.

Overall, there are several factors contributing to Zoom’s stock price decline, but the company still has a bright future ahead of it. Investors should keep an eye on Zoom’s growth trajectory and its competitive landscape to see if the stock price begins to rebound.”

Смогут ли акции Peloton снова вырасти и когда

Акции производителя интерактивных тренажеров Peloton (PTON) надеются протестировать новый минимум на уровне около 19 долларов. Это было такое массовое падение для компании, что инвесторы не могли насытиться на протяжении большей части 2020 года.

На фоне неблагоприятных сопоставимых показателей акции в конечном итоге рухнули, потеряв все свои огромные доходы от пандемии. Хотя ходили слухи о вмешательстве потенциального покупателя, с тех пор такие разговоры утихли, и мало что могло удержать любимца от пандемии от дальнейшего отступления.

Я настроен оптимистично в отношении акций, в первую очередь из-за сильно заниженной оценки.

![What next stocks peloton zoom - [updated] january 2024](http://grandcapital73.ru/wp-content/uploads/2/5/9/259b3a4d563da9e3f8b74a137439a861.jpeg)