UnderTheDoormat

UnderTheDoormat is a premium homestay service for homeowners and guests in the high growth homestay sector. Delivering a more professional, high-quality service than P2P platforms, the company is merging two markets – homestays and hotels – to create a new one: The Branded Home Accommodation sector.

By offering a superior hospitality service in homes, UnderTheDoormat can reach homeowners and guests who would otherwise sit out the homestay revolution and by mastering the logistics of hotel-quality service across a distributed portfolio, the company can lead the market it is helping to create.

The list above includes startups whose aim is to help improve – and even disrupt – the proptech industry.

Likewise, Splento is helping to improve business – by creating visual content, tools and resources to aid marketing, attract new clients, highlight USPs, promote other advantages and much more…

As part of that, here is our free webinar on video content and how it can help your business – today.

For all your visual content you can record your videos yourself, or if you prefer – contact Splento for help.

We are experts in visual content – we make videos that make your business grow.

Contact Splento today:

Data source: crunchbase.com

Contact Splento if you are in need of:

HQO

Incorporated in January 2018, HqO’s mission is to help landlords create places people love by enabling a premium tenant experience through software. Their first client was the Innovation and Design Building in the Seaport District of Boston, Massachusetts, a 1.4 million square foot mixed-use complex owned by Jamestown L.P.

HqO targets Commercial real estate companies to allow them to strengthen relationships with current and prospective tenants. Their clients include the likes of Blackstone, Nuveen, Skanska to name a few. HqO offers a white label ability for their clients, available on both iOS and Android and believe that building in feedback loops allow people in a building to feel heard, understood, and valued.

Pricing for HqO is based on an annual subscription, with prices based on the total sq ft being used. You can find the link to the HqO website below:

Vanessa Butz

Butz founded the U.K.-based startup District Technologies in 2017. District Technologies is a mobile-based workplace platform that facilitates the use of “Space-as-a-service”. Butz believes that technology needs to be leveraged in a way that improves people’s lives and helps build a community to make this happen, District Technologies provides services to two groups— companies that need office spaces and property owners.

On one hand, it allows office communities to stay connected from anywhere in the world. Using District Technologies’ platform, companies can rent out office spaces as per their need and otherwise stay connected over the mobile platform. On the other side of the spectrum, it allows owners of these office spaces to manage operations providing one single platform for a streamlined interaction between landlords, property managers and the companies renting out the space.

Guesty

Website LinkedIn

Founded in: 2013

Headquarters: Tel Aviv, Israel

Latest Funding: $50 million on April 26, 2021 at Series D stage.

Guesty creates software for property managers. The service simplifies and transfers all stages of the manager’s work online.

Guesty offers its customers a mailbox that collects all messages from third-party sites used by the property manager (for example, Airbnb and Booking), a calendar, in which bookings are automatically entered, and analytics: statistics on rent, expenses and revenue.

The technologies that Guesty uses are artificial intelligence and machine learning. For example, the service collects information about the demand for rent in a particular location, depending on which it automatically raises or lowers the price.

Locale

Founded in 2005, Locale provides a well-rounded solution, delivering great customer experience and facilities management. Their platform has been described as making up the DNA of a building – seamlessly integrating and improving existing processes and creating happier places to live & work. They also have a strong focus on providing human support, with a highly trained customer services team.

The completely white labelled app has been rolled out to companies such as MAPP, The Shard, BNP Paribas, CBRE, Cushman & Wakefield, and is used by Residential, Commercial, Mixed-Use, Retail & Industrial companies.

Locale’s pricing structure is modular and is calculated per building or client portfolio. You can find the link to the website below:

Финансовый рейтинг страховых компаний

Финансовый рейтинг сравнивает страховщиков на основании статистических показателей. В основе финансового рейтинга лежит официальная отчётность страховщиков, которая ежеквартально публикуется «Центробанком России». В расчёт принимаются продажи страховых услуг юридическим и физическим лицам.

Ключевой оцениваемый показатель – уровень выплат. Уровень выплат показывает процент сборов, который страховая компания выплатила за год в качестве страхового возмещения. Оптимальный уровень выплат на российском рынке составляет примерно 55-65%.

Если процент слишком большой (скажем, 75% и выше) – страховая компания неадекватно оценивает риски либо существенно сокращает объёмы продаж. Обе ситуации говорят о потенциальных финансовых проблемах страховщика.

Если процент слишком маленький (скажем, 40% и меньше) – страховщик вероятно экономит на выплатах. Компания занижает суммы страховых возмещений либо часто отказывает в выплате по страховым случаям. Косвенно подтверждением такой гипотезы служит судебный рейтинг страховых компаний. Если компания «экономит» на выплатах, почти наверняка у неё также большой процент судебных разбирательств по отношению к заявленным убыткам.

Рейтинг в сфере бизнеса и маркетинга

В современном бизнесе рейтинговые списки являются важным инструментом для привлечения инвестиций, клиентов и сотрудников. В маркетинге рейтинги помогают компаниям оценить свою позицию на рынке и сравниться с конкурентами.

Одним из наиболее популярных рейтингов в сфере бизнеса является Fortune 500, где каждый год публикуется список крупнейших американских компаний по доходам. Этот рейтинг становится отличным инструментом для инвесторов, которые могут оценить финансовое состояние компании и принять решение инвестировать в нее или нет.

В маркетинге рейтинги помогают компаниям оценить свою позицию на рынке и сравниться с конкурентами. Один из таких рейтингов — Forrester Wave, который оценивает качество продуктов и услуг в некоторых отраслях. Другой известный рейтинг — Net Promoter Score (NPS), который позволяет измерить лояльность клиентов и определить, какие изменения требуются в работе компании для улучшения ее репутации.

Рейтинги также могут помочь компаниям выбирать партнеров и поставщиков. Например, рейтинг крупнейших поставщиков IT-услуг Gartner Magic Quadrant помогает компаниям определить лучших партнеров, а также выбрать наиболее подходящее решение для решения своих проблем.

Таким образом, рейтинговые списки в сфере бизнеса и маркетинга играют важную роль в оценке конкурентных преимуществ компаний, выборе партнеров и поставщиков, а также привлечении инвестиций и клиентов.

5 PropTech Companies Leading the Space

There are many categories of PropTech. In this section, we’ll provide an overview of the top five companies across all categories, as well as which services and tools they each provide.

1. Zillow

Zillow was founded in 2004 as a website designed to help individuals find properties to buy. More than 15 years later, the PropTech startup has expanded its offerings to provide a variety of other services and become a leader in consumer real estate technology. Today, the company offers services like brokerage for homebuyers and connects renters to property owners with available rental units. It also provides professional-level accounts for realtors that allow real estate agents to advertise residential real estate listings and connect with potential buyers.

2. Zumper

Zumper works to connect renters with rental properties, with a specialized focus on apartment rentals. The platform has a user-friendly interface that allows renters to search for properties in their area by specifying whether they are looking for a long-term or monthly rental. The platform helps match renters to units by offering virtual tours and real-time alerts when new units become available. It also acts as property management software for landlords, allowing them to post available units, screen rental applicants, and collect rent payments.

The platform recently beat out the competition by adding a new service. Zumper expanded to offer services similar to Airbnb, allowing individuals to use the system to search for apartments that they can rent for a few nights at a time.

3. Reonomy

Reonomy is a New York-based startup that is quickly becoming a leader in property tech. It collects data from 100 different sources and serves as a “massive database of commercial property intel.” Investors, lenders, and brokers use Reonomy’s database to access commercial real estate data to help identify deals. Reonomy offers a web-based platform for easy access or an API integration that works with other platforms that real estate professionals commonly use.

4. Blend

Blend is a growing FinTech company that works to connect homebuyers with lenders. Its primary function is to help homebuyers get approved for mortgages, and the system handles “more than $3.5 billion in mortgages and consumer loans” every day. Users can link Blend to banking, tax, and pay forms online to streamline the mortgage application process for applicants. The platform offers assistance to homebuyers from when they first start an application until they close on a home.

Recently, Blend has set itself apart as a leader by expanding its offerings to include other types of banking services, in addition to financing home loans. This recent evolution means that users can now apply for credit cards and open deposit accounts through Blend. In addition to home loans, users can also apply for other types of loans through Blend, including personal and auto loans.

5. Kin

Entrepreneur Sean Harper and co-founder Lucas Ward started Kin Insurance in 2016. Since then, Kin has quickly become one of the fastest-growing companies in insurance tech. Kin uses intuitive tech to provide affordable insurance options to homeowners. Users can customize their preferences with just a few clicks on the platform, and then Kin will automatically match users with coverage plans. The insurance provider keeps its own prices low by relying on tech and automation, which translates to lower costs for users.

Real estate landscape in the US in 2023

The US real estate market in 2023 is characterized by a combination of factors, including increased demand for housing, the influence of remote work, urbanization trends, and a focus on sustainability. The proptech industry is playing a vital role in meeting these challenges, bringing innovative solutions to the forefront. From AI-powered tools that optimize property management to platforms that simplify the homebuying process, proptech companies are transforming the way real estate transactions are conducted in the US.

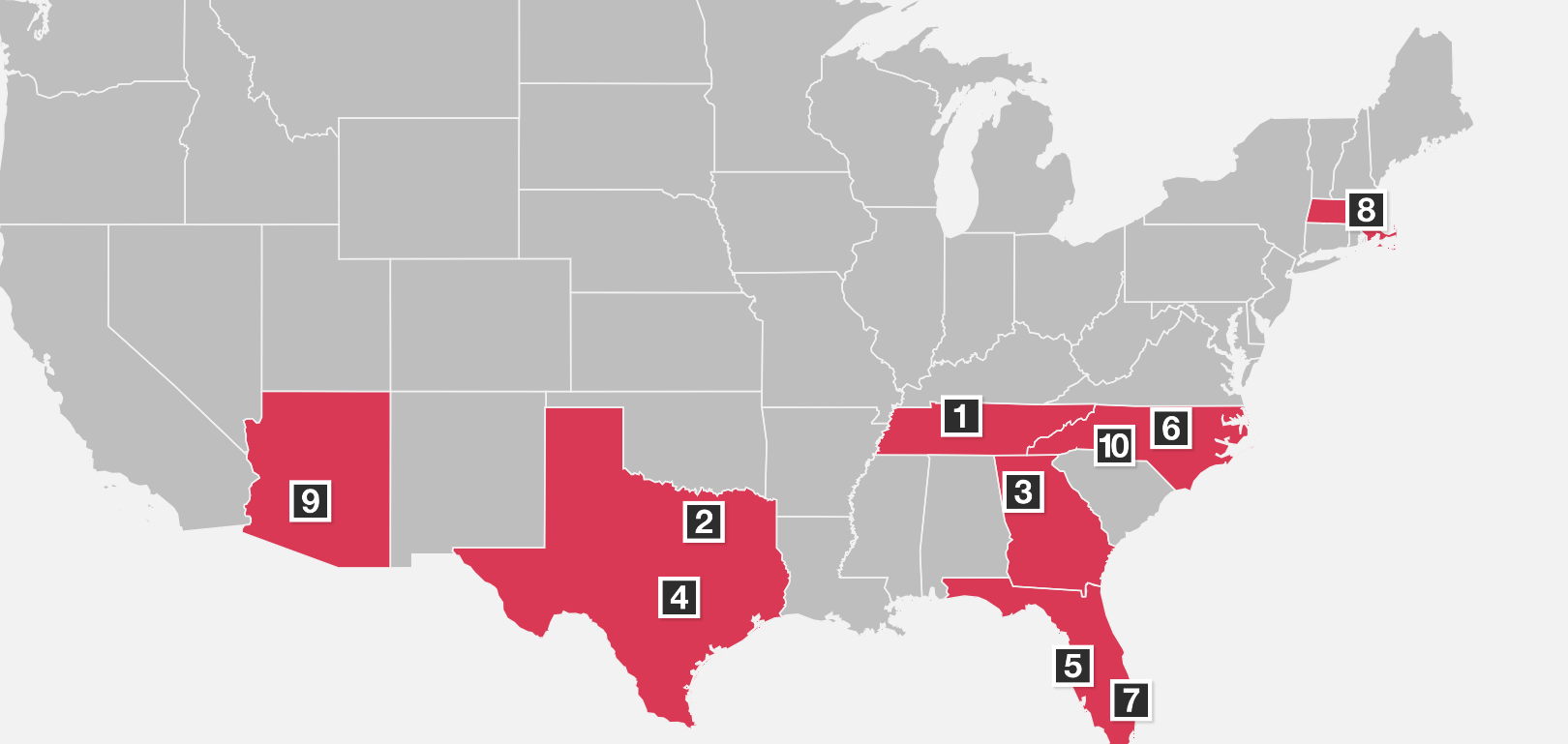

Source: PWC Emerging Trends in Real Estate 2023 report

In their newest report PWC states that the real estate industry is undergoing a mix of normalization and permanent shifts due to the impact of the COVID-19 pandemic. Certain aspects are returning to their pre-pandemic patterns, while others have embraced a «new normal» in how and where properties are utilized.

This year’s Emerging Trends report emphasizes the prominence of «magnet» markets, primarily located in warmer Sun Belt regions. These markets dominate the «Markets to Watch» rankings, while the number of cold-weather climates in the Northeast and Midwest has declined in ranking.

Most of the highly ranked real estate markets in this year’s survey are found in rapidly growing southern and western regions, moving away from the coastal areas. Nashville retains its position as the top-rated metro area, with the Dallas/Fort Worth area jumping five spots to secure the second rank. The Atlanta metro area also saw significant improvement, climbing to the third spot from last year’s eighth position. Factors such as quality of life and affordability strongly influence people’s choices of where to live.

Some markets received lower scores this year due to insufficient infrastructure for their population size and growth. While Raleigh, Phoenix, and Charlotte experienced a slight decline in rankings, they still remain in the top 10. Seattle dropped out of the top 10 list due to slower coastal growth, while Miami climbed up to secure the seventh ranking.

Overall, the real estate landscape is experiencing both expected trends and lasting shifts, with magnet markets in warm regions leading the way and factors like quality of life and infrastructure playing a crucial role in market rankings.

Also, RlanRadar states that in 2023 the PropTech industry in the US:

Selection rules for our top 10 fast-growing list of proptech companies

To curate our list of the top 10 fast-growing proptech companies in the US in 2023, we carefully considered the following criteria:

-

Growth in headcount: We focused on companies that demonstrated significant growth in their workforce, with a headcount increase of over 20% in the past year. This criterion indicates the company’s expansion and ability to attract and retain talent.

-

Company size: We specifically looked for companies that fall within the range of 25 to 200 employees onboard. This criterion ensured that we included companies that have achieved notable growth but are still in a growth phase themselves.

-

US-based team and leadership: We gave preference to companies with a significant portion of their team and leadership based in the United States. This criterion emphasizes the companies’ local presence and their contribution to the US proptech ecosystem.

-

Expertise and experience: Our selection process involved leveraging our experience and knowledge in the proptech and real estate market. We considered companies that showcased unique and innovative approaches to solving industry challenges, distinguishing them from their competitors.

Based on these criteria, we have compiled our list of the top 10 fast-growing proptech companies in the US in 2023.

TOP 100 BRANDS

We also looked at all the brands engaging on Twitter to bring you a list of the top brands talking about proptech. Below is the top 50, if you want to see who ranks from 50-100 be sure to download the report to get the full top 100 list, and see who are most the influential brands in proptech.

| Rank | Twitter Handle | Name | Influencer Score |

|---|---|---|---|

| 1 | @RICSnews | RICS | 100 |

| 2 | @MetaPropNYC | MetaProp NYC | 72.79 |

| 3 | @TechCityNews | Tech City News | 65.43 |

| 4 | @LendInvest | LendInvest | 58.33 |

| 5 | @HollandPropTech | Holland PropTech | 56.83 |

| 6 | @EstatesGazette | Estates Gazette | 50.95 |

| 7 | @Proptechglobe | Proptech Globe | 49.43 |

| 8 | @Hightower | Hightower | 48.96 |

| 9 | @HollandConTech | Holland ConTech | 43.65 |

| 10 | @MIPIMWorld | MIPIMWorld | 40.5 |

| 11 | @Pi_Labs | Pi Labs | 36.33 |

| 12 | @viewthespace | VTS | 35.78 |

| 13 | @PropertyWeek | PropertyWeek | 33.14 |

| 14 | @_futureproperty | FUTURE:PropTech | 32.97 |

| 15 | @HelloTrussle | Trussle | 29.89 |

| 16 | @my_spd | Shared Property Data | 28.52 |

| 17 | @SeiichiShiga | Real Estate Tech | 28.5 |

| 18 | @header_labs | HeaderLabs | 26.5 |

| 19 | @noagentapp | No Agent | 25.77 |

| 20 | @cretech | cretech | 25.74 |

| 21 | @CushWakeUK | Cushman & Wakefield | 25.56 |

| 22 | @propertydetect | Property Detective | 25.38 |

| 23 | @ZIAunterwegs | ZIA | 24.75 |

| 24 | @PortalWatch | PropertyPortalWatch | 23.62 |

| 25 | @NoLettingGo | No Letting Go | 21.75 |

| 26 | @Vacayo_Tech | Vacayo | 20.6 |

| 27 | @exporeal_team | EXPO REAL | 19.46 |

| 28 | @Fixflo | Fixflo | 19.16 |

| 29 | @DatschaUK | Datscha UK | 18.97 |

| 30 | @sogoodlord | Goodlord | 17.42 |

| 31 | @PropIndEye | PropertyIndustryEye | 16.35 |

| 32 | @WiredScore | WiredScore | 16.12 |

| 33 | @retechinc | RE:Tech | 15.91 |

| 34 | @kykloud | Kykloud | 15.78 |

| 35 | @Konii_de | Konii.de | 15.63 |

| 36 | @EstateAppsUK | Estate Apps | 15.45 |

| 37 | @TrackMyMove | TrackMyMove | 15.36 |

| 38 | @immofux | IMMOFUX Makler | 14.73 |

| 39 | @Getmyreposit | Reposit | 14.4 |

| 40 | @PropTechNL | PropTechNL | 13.57 |

| 41 | @AssettiSW | Assetti | 13.36 |

| 42 | @CompStak | CompStak | 13.28 |

| 43 | @GetLandInsight | Land Insight | 13.08 |

| 44 | @TheNeg | The Negotiator | 12.93 |

| 45 | @EAUKNetworking | Estate Agent Network | 12.83 |

| 46 | @TheMemo | The Memo | 12.75 |

| 47 | @Matterport | Matterport | 12.46 |

| 48 | @movebubble | Movebubble | 12.37 |

| 49 | @immomanager | immobilienmanager | 12.33 |

| 50 | @LEVERTON | LEVERTON | 12.28 |

At Onalytica we love building these lists and want to give back to our loyal readers as much as we can. If you’re interested in other topics (such as Virtual Reality, Digital Health, Digital Marketing) be sure to have a gander on our blog or why not propose some topics to us on ?

Effective influencer marketing starts with identifying relevant influencers for your brand. Onalytica’s new Discovery platform mines over 200 billion posts a year into a curated database of over 150K global social media influencers, including data from Twitter, Blogs, Instagram, YouTube, Facebook, LinkedIn Profile Links + Demographic Data. These influencers are then ranked by Reach, Resonance, Relevance and Reference.

Disclaimer: As ever with these lists, it must be stressed that the ranking is by no means a definitive measurement of influence, as there is no such thing. The brands and individuals listed are undoubtedly influential when it comes to driving discussion around League of Legends.

Disclaimer: As ever with these lists, it must be stressed that the ranking is by no means a definitive measurement of influence, as there is no such thing. The brands and individuals listed are undoubtedly influential when it comes to driving discussion around PropTech.

The PageRank based methodology we use to extract influencers on a particular topic takes into account the number and quality of contextual references that a user receives. These calculations also take into account a user’s relevance (number of tweets on topic) and reach (number of followers). If you want to learn more, please read our article that outlines influencer identification.

Экспертный рейтинг страховых компаний

Экспертный рейтинг страховых компаний (или рейтинг надёжности страховых компаний) составляется на основе данных авторитетного рейтингового агентства «Эксперт РА». При определении рейтинга оцениваются финансовые показатели страховщиков. Согласно классификации «Эксперт РА», используются следующие оценки:

- Максимальный уровень надёжности.

- , , Очень высокий уровень надёжности.

- , , Высокий уровень надёжности.

- , , Удовлетворительный уровень надёжности.

- , , Удовлетворительный уровень надёжности.

- , , Низкий уровень надёжности.

- Очень низкий уровень надёжности.

- Неудовлетворительный уровень надёжности.

- Неисполнение обязательств.

- Введена временная администрация.

- Банкротство, отзыв лицензии, ликвидация.

Рейтинг надёжности страховых компаний постоянно актуализируется в течение года. В списке представлено 50 СК России, среди которых:

- 5 СК – оценка «Максимальный уровень надёжности» (ruAAA): АльфаСтрахование, Газпром страхование, Ингосстрах, Сбербанк страхование, СОГАЗ.

- 13 СК – оценка «Очень высокий уровень надёжности» (ruAA+, ruAA, ruAA-): ВСК, Гардия, Интач, МАКС, Ренессанс Жизнь, Ренессанс Страхование, РЕСО-Гарантия, Росгосстрах, РСХБ-Страхование, Совкомбанк Страхование, Согласие, Тинькофф Страхование, Югория.

- 12 СК – оценка «Высокий уровень надёжности» (ruA+, ruA, ruA-): Абсолют Страхование, Альянс, Д2 Страхование, Зетта Страхование, Мафин, Медэкспресс, ОСК, ПАРИ, Спасские ворота, Сургутнефтегаз, Чулпан, Энергогарант.

- 4 СК – оценка «Удовлетворительный уровень надёжности» (ruBBB+, ruBBB, ruBBB-, ruBB+, ruBB, ruBB-): ЕВРОИНС, Инлайф страхование, Стерх, Страховая бизнес группа.

- 2 СК – оценка «Низкий уровень надёжности» (ruB+, ruB, ruB-): АСКО-СТРАХОВАНИЕ, Гелиос.

Высокая оценка (ruА- или выше) – это признание надёжности компании со стороны экспертного сообщества. Описанный расклад отражает ситуацию по состоянию на 09.01.2024.

What Is Proptech?

Short for property technology, Proptech is a term used to describe companies that offer innovative technological solutions for the real estate sector. Proptech companies essentially create tools and solutions by leveraging tech to increase the efficiency of a service in the real estate sector.

As explored throughout our top 10 list, examples of Proptech companies can vary considerably, ranging from tenant engagement platforms to management systems for co-working spaces.

Proptech is helping to disrupt the the real estate industry, offering innovative new ways to manage its various different challenges. Whilst now an established and well-known part to our digital landscape, Proptech has only recently developed into the disruptor it is today, funding for the sector reaching a staggering $13.85 billion in 2019.

Introduction

The real estate technology industry, also known as proptech, has experienced significant growth and transformation in recent years. It has revolutionized the traditional real estate landscape through the introduction of innovative technology and solutions. In this article, we will explore the top 10 fast-growing proptech startups in the US in 2023. These startups have made remarkable strides in reshaping the industry and have become influential players in the market.

With a focus on property management and catering to the needs of property owners, these startups have developed cutting-edge tools and platforms that streamline operations and enhance the overall experience for both property managers and owners. Their impact extends beyond North America, as their solutions are gaining traction globally.

These proptech startups have garnered substantial funding, which has fueled their growth and expansion. We will delve into their success stories, highlighting their total funding and the significant milestones they have achieved. As the proptech industry continues to thrive, these startups are at the forefront of innovation, driving the evolution of the real estate market with their transformative technology and solutions.

TOP 100 INDIVIDUALS

We looked at all the individuals engaging on Twitter to bring you a list of the top influencers in PropTech. Below is the top 50, if you want to see who ranks from 50-100 be sure to download the full report by clicking the download button below.

| Rank | Twitter Handle | Name | Company | Influencer Score |

|---|---|---|---|---|

| 1 | @PropertyDanH | Dan Hughes | RICSnews | 100 |

| 2 | @jamesdearsley | James Dearsley | The Digital Marketing Bureau | 88.01 |

| 3 | @JonasHaberkorn | Jonas Haberkorn | Propteq | 51.54 |

| 4 | @sabineschoorl | Sabine Schoorl | Holland PropTech | 30.82 |

| 5 | @eddieholmes84 | Eddie Holmes | Upad | 24.88 |

| 6 | @Juliettemorgan | Juliette Morgan/John | Cushman & Wakefield | 20.99 |

| 7 | @WouterTruffino | Wouter Truffino | Holland PropTech | 19.78 |

| 8 | @aaronnblock | Aaron Block | MetaProp NYC | 18.17 |

| 9 | @tompeters1 | Tom Peters | Sky | 17.42 |

| 10 | @magnus_s | Magnus Svantegård | Datscha AB | 17.09 |

| 11 | @wfvanderplas | Wilfred van der Plas | Simaxx B.V. | 16.54 |

| 12 | @RyanDennisLive | Ryan Dennis Live | CoinStructive | 16.1 |

| 13 | @NickNoLettingGo | Nick Lyons | No Letting Go | 15.09 |

| 14 | @CalumBrannan | Calum Brannan | No Agent | 14.7 |

| 15 | @BarkowConsult | Peter Barkow | Barkow Consulting | 14.63 |

| 16 | @antonyslumbers | Antony Slumbers | Vicinitee | 14.2 |

| 17 | @BrandonGWeber | Brandon Weber | Hightower | 13.78 |

| 18 | @Ishaan_trussle | Ishaan Malhi | Trussle | 13.3 |

| 19 | @HenryPryor | Henry Pryor | henrypryor.com | 12.8 |

| 20 | @dinisguarda | Dinis Guarda | Ztudium | 12.79 |

| 21 | @SamuelHortiPW | Samuel Horti | Property Week | 12.71 |

| 22 | @amanda_clack | Amanda Clack | RICS, EY | 12.5 |

| 23 | @DamianWild | Damian Wild | Estates Gazette | 11.83 |

| 24 | @Ragnarly | Ragnar Lifthrasir | IBREA | 11.75 |

| 25 | @Exp_Mark | Mark Esposito | Harvard University | 11.73 |

| 26 | @RealEstateTek | @RealEstateTek: Josh | Real Estate Technology | 11.67 |

| 27 | @MichaelBleby | Michael Bleby | Financial Review | 11.25 |

| 28 | @Paul_Maes | Paul Maes | Business.nl | 10.86 |

| 29 | @Josh_Artus | Josh Artus | The Centric Lab | 10.36 |

| 30 | @ronniegproperty | ronniegproperty | Howard Cundey | 10.32 |

| 31 | @Propertyshe | Susan Freeman | Estates Gazette | 10.24 |

| 32 | @EmilyW_9 | Emily Wright | Estates Gazette | 10.15 |

| 33 | @OscarWGrut | Oscar Williams-Grut | Business Insider UK | 10.14 |

| 34 | @ChristianFaes | Christian Faes | LendInvest | 9.92 |

| 35 | @MennoLammers | Menno Lammes | PropTechNL | 9.91 |

| 36 | @hussainalhilli | Hussain Al Hilli | Byoot | 9.46 |

| 37 | @RayProptech | Ray Proptech | unmortgage | 9.37 |

| 38 | @NicholasKatz | Nick Katz, FRICS | Splittable | 8.85 |

| 39 | @WorkstationW | Bill Lewis | Instant Office | 8.55 |

| 40 | @CaseyRutland | Casey D Rutland | digital green | 8.53 |

| 41 | @Dom7Wilson | Dominic Wilson | Pi Labs | 8.38 |

| 42 | @SebAbigail | Sebastian Abigail | VTS Inc | 8.17 |

| 43 | @JMAugustyn | Julie M. Augustyn | Foundry Commercial | 7.83 |

| 44 | @morris_manuel | James Morris-Manuel | Matterport | 6.72 |

| 45 | @CarolTallon | Carol Tallon | caroltallon.com | 6.6 |

| 46 | @RICSchiefexec | Sean Tompkins | RICS | 6.52 |

| 47 | @Kr1shnaa | Krishna Chandran | Infosys | 6.51 |

| 48 | @EvaHukshorn | Eva Hukshorn | OVG Real Estate | 6.36 |

| 49 | @timfproperty | Tim Foulkes | Howard Cundey | 6.34 |

| 50 | @samanthamcclary | samantha mcclary | Estates Gazette | 6.14 |

Судебный рейтинг

Судебный рейтинг оценивает, сколько судебных тяжб с участием страховой компании приходится на один заявленный страховой случай. Далеко не всегда страховщики судятся со страхователями. Порой оппонентами в суде выступают две страховые компании. Также финансисты судятся с другими субъектами права по не страховым делам, например, с арендодателями или государственными органами.

Однако практика показывает, что львиная доля судебных разбирательств приходится именно на тяжбы со страхователями. Вот почему судебный рейтинг страховщиков позволяет довольно точно оценить вероятность судебной тяжбы при заявлении страхового случая.